Forrest Xiaodong Li

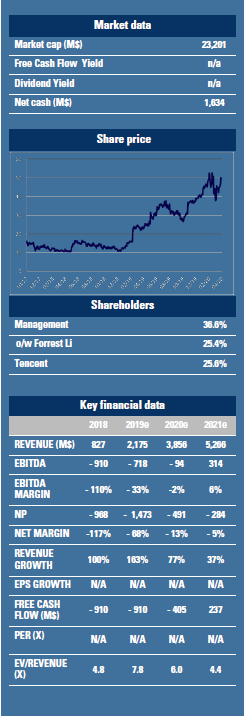

Forrest Li, a 42 years old Chinese born entrepreneur, found his inspiration in Steve Jobs' Commencement speech in 2005 when he was still a Stanford MBA student. As he followed Jobs' advice to "stay hungry, stay foolish", Li founded Singapore's largest internet company in 2009. Sea Ltd. is now considered the ASEAN response to Tencent and Alibaba combined. Since its IPO in October 2017, Sea Ltd.'s share price has increased 370% and the company has grown into a US$23bn company. Li remains the major shareholder and controls 25.4% of the company and 38.8% of voting rights.

Just a decade ago, barely 20% of Southeast Asian people had limited or no access to internet.

Today, despite its already large user base at 360M, the ASEAN region (Indonesia, Philippines, Thailand, Malaysia, Vietnam, Laos, Cambodia and Singapore) remains the fastest growing internet market in the world.  After surpassing US$100bn last year, the internet economy there could triple by 2025. This strong growth is backed by structural drivers such as a large youth population (570M people, of which 31% are millennials), growing digitalization and rising income. It is especially beneficial for the development of various internet sectors such as ecommerce, gaming, online media, ride hailing, etc...

After surpassing US$100bn last year, the internet economy there could triple by 2025. This strong growth is backed by structural drivers such as a large youth population (570M people, of which 31% are millennials), growing digitalization and rising income. It is especially beneficial for the development of various internet sectors such as ecommerce, gaming, online media, ride hailing, etc...

As an integrated internet company focused on ASEAN plus Taiwan, the Singapore-based Sea Ltd. is one of the best positioned companies to seize these wonderful opportunities.

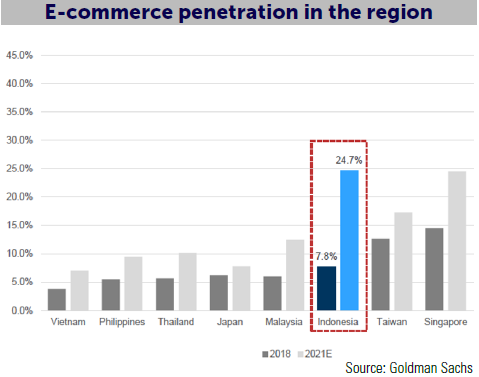

Founded in 2009 as a regional game publisher under the name of Garena, the digital entertainment company helps global developers to localize and operate the online games in each market. It is also a content provider offering live streaming of online gameplay, as well as social features (user chat, forums). As Garena succeeds its publishing business and builds strong customer relationships (Tencent, its biggest customer became a strategic investor since 2010 and holds a 25.6% stake), it launched Free Fire, its first fully self-developed game in Dec 2017. Ranked as the most downloaded mobile game worldwide in 2019, Free Fire has more than 450M registered players and 60M peak daily active users. This success has expanded Garena addressable market to the much larger and profitable self-development game market and as well as its geographic reach (50% of gaming revenues is generated from Latam, Russia and India). It has also become the financial backbone (Garena adj. EBITDA reached US$1bn in 2019 vs $263M in 2018) for Sea’s other highly attractive but loss-making businesses such as e-commerce (Shopee) and digital payment (SEAMoney).  Given the low penetration rate across the region (5-10%) and undergoing structural changes, e-commerce has emerged as the largest internet sector (US$38bn in 2019 vs US$5,5bn in 2015) with sustainable growth prospects.

Given the low penetration rate across the region (5-10%) and undergoing structural changes, e-commerce has emerged as the largest internet sector (US$38bn in 2019 vs US$5,5bn in 2015) with sustainable growth prospects.

Shopee is the largest e-commerce platform in the region by GMV and total orders and Lazada (Alibaba)’s strongest competitor in ASEAN.

Its mobile-first approach and focus on long tail high margin categories (fashion, health, beauty, home and baby) have helped the company to differentiate itself from competition. 2/3 of its GMV is generated from third party marketplace (C2C, similar to Alibaba’s Taobao) while the fast-growing B2C platform (Shopee Mall) contributes the rest. As it continues to generate high growth (e-commerce revenue is expected to grow 80-90% yoy this year), the take rate (5%) also enjoys steady improvement as a result of value-added services and B2C expansion. We expect this division to turn EBITDA positive in 2022. As to SeaMoney, although the digital financial services business faces tough competition from many pure players, it has clear synergies with the other 2 divisions. It helps Sea Ltd. to enhance its ecosystem and improve user stickiness. At the beginning of this year, ShopeePay had been opted for 30% of Shopee orders from Indonesia. We expect this penetration to further increase and so does its payment TPV. New initiatives in lending (KBank partnership, roll out of ShopeePaylater feature) bring additional revenue streams, further stimulating e-commerce growth. We expect the company to grow its revenue at a 36% CAGR for the next 3 years and its consolidated EBITDA to break even in 2021. With US$1.6bn of net cash, Sea Ltd. is able to finance its operating loss (negative EBITDA 2020e: US$94m; negative FCF: US$400m). The stock trades at EV/Sales of 5.6x in 2020 and 4.1x for 2021. We find the company very attractive because it is a unique play on the ASEAN internet sector where it has established dominant position in both gaming and e-commerce. GemEquity and GemAsia have both invested 3% of their assets in the company.