LI NING

Li Ning, the 1984 Los Angeles Olympic Games champion and China’s “Prince of Gymnastics”, founded the eponymous sporting goods company after retiring from his athlete career in 1989. As a businessman, Li led this first Chinese national sporting goods company to its IPO in Hong Kong in 2004. The business grew rapidly after Li lit up the Olympic flame at the 2008 Beijing Olympic Games and took off again in 2018 thanks to its successful upgrading into sports fashion. The company's market capitalisation has expanded by 3x over the past 3 years.

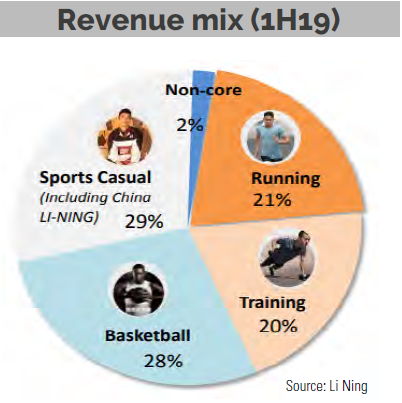

Founded in 1989, Li Ning is a leading Chinese sports brand, specializing in apparel, footwear and accessories (49%, 47%, 4% of sales mix respectively).

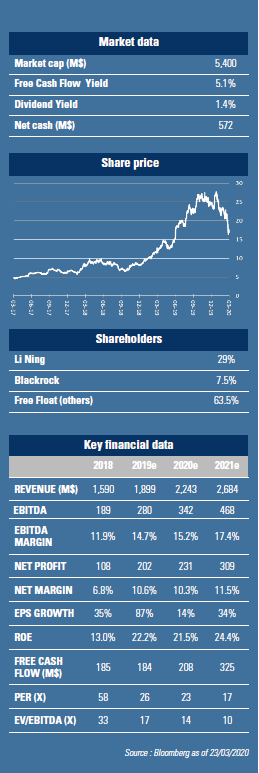

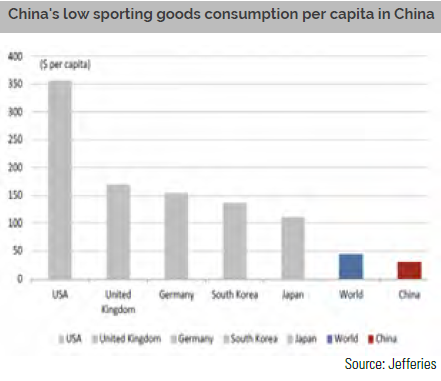

China's sportswear market reached $44bn in 2019 and is expected to grow at a 2019-2023 CAGR of 10%, faster than most other apparel segments. Penetration is still low with barely 40$ spent per annum per capita on sporting goods as  compared to 350$ in the US or 150$ in Korea (cf chart below). Rising awareness of well-being, fashion aspect and government support are the key drivers. More sport events are being organized as Mr Xi aims to increase GDP contribution of sport industry from 1% to 4% by 2035. The number of marathon runners for instance increased from 0.4M in 2011 to 6M in 2018. As one of the leading players in China, Li Ning ($1.9bn sales in FY19 vs $6.7bn for Nike China) is well poised to benefit from the booming market. Over the years, the company went through different phases but the most recent is marked by the return of its emblematic founder as executive CEO in 2015. Poorly run by previous "professional" CEO, the company ran into inventory mismanagement issues and underinvested in the brand. It resulted in huge losses over 2012-2014. To revive the company, Li Ning focused first on fixing working capital issues bringing average inventory turnover days from 109 in 2014 to 74 in 1H19. He launched various initiatives for brand repositioning to focus on young customers and distribution optimization to allow faster reaction to demand changes.

compared to 350$ in the US or 150$ in Korea (cf chart below). Rising awareness of well-being, fashion aspect and government support are the key drivers. More sport events are being organized as Mr Xi aims to increase GDP contribution of sport industry from 1% to 4% by 2035. The number of marathon runners for instance increased from 0.4M in 2011 to 6M in 2018. As one of the leading players in China, Li Ning ($1.9bn sales in FY19 vs $6.7bn for Nike China) is well poised to benefit from the booming market. Over the years, the company went through different phases but the most recent is marked by the return of its emblematic founder as executive CEO in 2015. Poorly run by previous "professional" CEO, the company ran into inventory mismanagement issues and underinvested in the brand. It resulted in huge losses over 2012-2014. To revive the company, Li Ning focused first on fixing working capital issues bringing average inventory turnover days from 109 in 2014 to 74 in 1H19. He launched various initiatives for brand repositioning to focus on young customers and distribution optimization to allow faster reaction to demand changes.

In recent years domestic brands with original designs incorporating Chinese characteristics and history have been gaining traction.

In recent years domestic brands with original designs incorporating Chinese characteristics and history have been gaining traction.

Following this trend, Li Ning showcased its premium collection "China Li Ning" at the 2018 New York Fashion Week. The fashion show quickly boosted its fame as a unique domestic sportswear brand associated with a Chinese Olympic champion, making Li Ning a new love of young Chinese customers who grew up in China’s prosperous years hence are proud to express their patriotism through fashion. "China Li Ning" line now contributes close to 10% of sales. For distribution the company relies on 7,300 stores (5,000 franchised, 50% of sales and 1,300 directly operated, 27% of sales) and e-commerce (23% of sales).

Operating metrics improved significantly since 2015: revenue doubled while its EBIT went from loss to 11% margin in 1H19. The company spends 31% of its revenue in marketing and sales support. As the company gains scale, margins are set to expand: Source: Li Ning ANTA Sports (another local brand) EBIT margin is 23% for $4,7bn in sales, Nike is 35% for $6,7bn in sales. Also Li Ning has been very successful in strengthening its higher margin e-commerce channel (23% of sales growing +38% in 1H19). Recently its digital strategy helped with direct personalized promotions.

Since the virus outbroke and people were confined in China, sales suffered.

The company however managed to sell 30% of its spring collection at full price in January which is a strong print. As 1Q and 3Q collections are similar (spring and autumn), instead of selling current inventory at huge discount, management decided to mild them, rather cut orders for automn collection and keep the inventory for now. Manufacturing is 100%done in China and outsourced to a variety of mid-sized manufacturers Not so lean manufacturing process of those suppliers is currently an advantage as it secures a higher portion of raw material and work in process inventory to support production. Hopefully the upcoming summer collection gets delivered on time by early April. We expect the company to grow its revenue with a 23%CAGR for the next 3 years and margins to expand as the company gains scale and increases online sales. The balance sheet is healthy with a net cash position. The stock trades at 23x PER 2020 and 17x PER 2021 on accelerating revenue and earnings growth. We find it attractive given the unique positioning and growth potential and recently initiated a 1% position in our funds (GemEquity, GemAsia and GemChina).