ZHANG BANGXIN

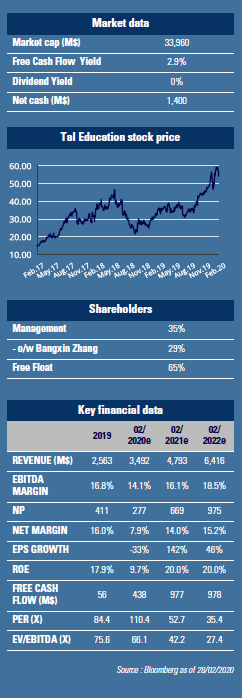

In 2003, Zhang, a 23-years old PhD student at Beijing University, launched an online mathematics forum. It was the period of SARS and schools were closed. Having succeeded with the forum, he decided to open his first tutoring center and in 2005 established the Xueersi company (former name of TAL). As business grew and Zhang wanted to devote all his time to it, he dropped out from Beijing University. In 2010, TAL went public, valued at $1.3bn. Since then, its market capitalization has increased by 22x and his 29.7% stake is now worth $8.5bn.

Following Covid-19 outbreak, students in China and Hong Kong have been prevented from returning to physical class rooms.

Shanghai has just announced that schools will remain closed indefinitely. However given the importance of kids education for Chinese parents, gouvernment support and technology advances, online education became a valuable alternative. Shanghai for example has just established an official online education platform in collaboration with Tencent to allow its 1.5M students to continue studying. TAL Education foresaw the opportunity way ahead of the virus as the management has been increasingly emphasizing its online platform: 18% of revenue as of Dec-19, expected to double in 2 years.

Established in 2005, Tomorrow Advancing Life (TAL) Education is a leading K12 after school tutoring platform in China.

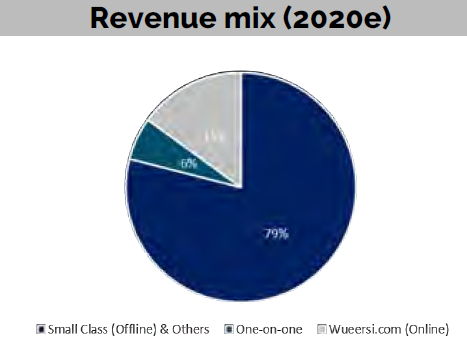

A market worth $80bn, growing at a steady 10% CAGR where TAL only commands a 3% share. After school turoring has grown popular due to imbalance between the number of seats offered by top universities in China and strong demand. Tiger "moms" and dads are ready to deploy heafty sums for their only (or at best two) children to get into best schools.  Even so, China's K12 tutoring penetration rate (28% in 2019) is still relatively low comparing with that of Japan at 51% or South Korea at 82%. The sector is also increasingly regulated by the governement. In 2018 it imposed more stringent teacher qualifications, introduced standardised facilities requirements and regulated fees collection. It affected revenues and costs in the short term, however benefitted strong established players such as TAL in the longer term. It raised quality standards and hence barriers of entry. A number of small schools disappeared. Initillaly TAL gained reputation with scientific classes (math in particular) and later on expanded to English. Now it services all core K12 subjects mainly via 3 channels: 1) offline small classes (Peiyou), 2) 1-on-1 classes (Aizhikang) and 3) online courses (Xueersi.com). As of Dec-19 TAL's network covered 70 cities with nearly 1,000 learning centers

Even so, China's K12 tutoring penetration rate (28% in 2019) is still relatively low comparing with that of Japan at 51% or South Korea at 82%. The sector is also increasingly regulated by the governement. In 2018 it imposed more stringent teacher qualifications, introduced standardised facilities requirements and regulated fees collection. It affected revenues and costs in the short term, however benefitted strong established players such as TAL in the longer term. It raised quality standards and hence barriers of entry. A number of small schools disappeared. Initillaly TAL gained reputation with scientific classes (math in particular) and later on expanded to English. Now it services all core K12 subjects mainly via 3 channels: 1) offline small classes (Peiyou), 2) 1-on-1 classes (Aizhikang) and 3) online courses (Xueersi.com). As of Dec-19 TAL's network covered 70 cities with nearly 1,000 learning centers. The company had 2.3M students enrolled, paying on average $112 per month in 2019. The company has invested in proprietary curricula and education technologies, gaining them significant edges over competitors in both online (revenue growth +82% CAGR FY19-22e) and offline education (85% student retention rate).

TAL also pioneered with dual teacher and broadcasted master teacher classes (from Shanghai to a low tier city for instance, cf picture nearby).

In 2019 TAL entered 13 new cities, including one in the US. After growing its room capacity 13% in 2018, the management decided to accelerate in 2019: +17% YTD to reach 13,000 classrooms. It pressured operating expenses in 2019 as several quarters are needed before the property can be ready for use (renovation, license approval). We expect the company to growth its revenue with a 35% 3Y CAGR and margin expansion as the company gains scale and increases online portion. The stock trades at 53x PER March 2021 on reaccelerating earnings growth (+140% expected). We find it attractive given the gowth potential.