We just came back from Brazil where we spent 3 days at BTG Pactual conference, a great annual event for Brazil investors. We also conducted field trips in Sao Paulo and Rio de Janeiro.

In total, we met more than twenty companies from different sectors over one week including health plan providers Hapvida and Notre Dame Intermedica, financial group BTG Pactual and its subsidiary Banco Pan, dominant stock exchange operator Brasil Bolsa Balcäo (B3), largest online brokerage platform XP, specialty retail operators Lojas Renner, Arezzo, Magazine Luiza (e-commerce leader), CVC and BR Distribuidora, software editors Linx and Totvs, fintech groups Stone and PagSeguro, private education groups Afya and Cogna (ex. Kroton), highway concession companies CCR and EcoRodovias, privately held logistic companies Sequoia and Vamos (the latter will soon list publicly), dominant oil major Petrobras and iron ore key player Vale.

At time of our visit, Brazilian business leaders with whom we spoke felt little concerned with the risk of Covid-19 epidemic; Vale was the only exception as a result of its China dependent business. On the economic front, they applauded the progress achieved by the government under the leadership of Jair Bolsonaro and Paulo Guedes and felt confident in the long-awaited economic recovery, driven by domestic demand. Lojas Renner, Arezzo and CVC have all observed improved consumer confidence. However, some of them worry about potential slowdown in the pace of structural reforms. The adoption of the pension reform last year is an important step but there is no guarantee of future success. Some of the upcoming reforms are complex in nature (eg. Tax reform), the tension between executive and congress is hardly a secret to anyone and municipal election in October makes Congressional calendar shorter. We came back reassured by the messages from the private sector. However, the political dimension seems difficult to apprehend and we don’t expect meaningful recovery before the second half of 2020.

MACRO FOCUS

Exceptional decline in inflation, interest rates and currency

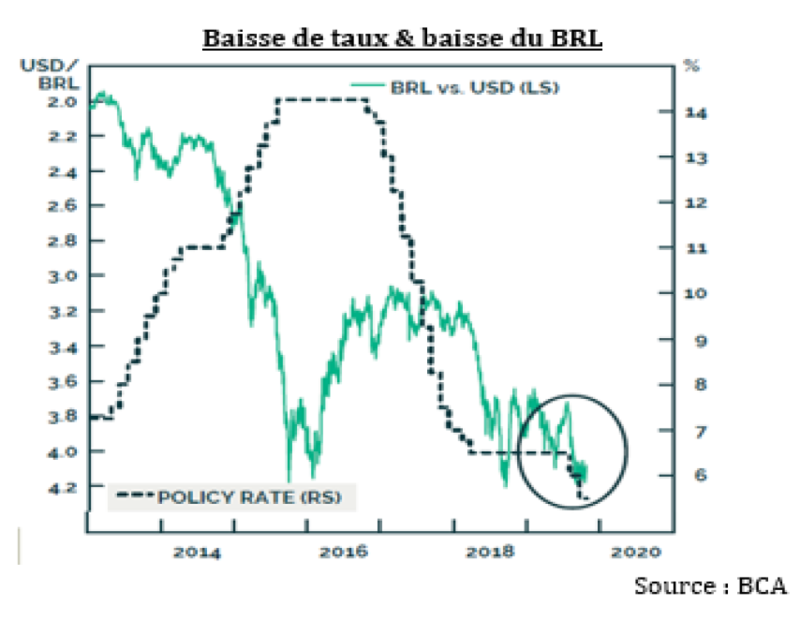

The Brazilian Real suffered sharp devaluation during the period of 2017-19: it dropped from 3.27 to 4.03 against USD, recording a 23% decline! Year to date, the correction has further accelerated, and the 20% decline makes the BRL the worst emerging markets currency of the year. This sharp correction could be first explained by successive cuts of interest rates as a result of expansionary monetary cycle initiated by Brazilian Central Bank (BCB) in the hope to restore economic growth. As a reminder, the benchmark Selic rate has dropped from 12.25% in 2017 to 4.25% as of today, a record low. Although the monetary policy committee (Copom) has signalled its intention to suspend cuts early February, the threat of coronavirus pandemic is pushing BCB to continue with further monetary easing and opens the door to further interest rates cuts. With inflation forecast at 3.25% (BCB projects 4%), Brazil’s real interest rates have never been so low! As a result, BRL has lost its historical status of high yielding currency and no longer appeals to “carry trade” investors.

As a reminder, the benchmark Selic rate has dropped from 12.25% in 2017 to 4.25% as of today, a record low. Although the monetary policy committee (Copom) has signalled its intention to suspend cuts early February, the threat of coronavirus pandemic is pushing BCB to continue with further monetary easing and opens the door to further interest rates cuts. With inflation forecast at 3.25% (BCB projects 4%), Brazil’s real interest rates have never been so low! As a result, BRL has lost its historical status of high yielding currency and no longer appeals to “carry trade” investors.

Another explication could be the growing scepticism of investors regarding the expected economic recovery. After 2 years of disappointment (forecast GDP growth at 2.5 to 3% in the beginning of the year vs. real growth at 1.3% for 2018 and 1.1% for 2019), the economic recovery is still tepid. Several indicators have turned weaker than expected: such is the case of current account deficit that increased in January (2.9% of GDP vs. 2.7% in December) or lower investment in 4Q19 (-3.3% qoq). On top of this, the growing threat of COVID-19 could affect export activities as well as the domestic economy (77 infection cases as of 12 March).

In the current context where world economic growth has downside risks, BRL joins other commodity currencies and oil all suffering strong correction. Since the beginning of the year, the Russian Ruble is down 17% against USD, the South African Rand is down 15% and the Chilean Peso down 12%.

Although we have little visibility on the recovery of the currency, we believe the correction has been excessive and current level (USD/BRL at 4.92) shall not be far from the bottom. On the macro front, Brazilian economy could generate better growth this year driven by domestic demand. On one hand, access to credit has been improved and job creation is in the right direction. Despite a still high unemployment rate, 39M jobs have been added to the formal sector in 2019, which is the highest level since 2013. On the other hand, this improved outlook and favorable monetary environment could encourage private investment. This scenario would change investors perception on the BRL: from a high yielding currency to neutral, and eventually to a growth currency!

STOCK FOCUS

Hapvida (Sales of $1.8bn, market capitalisation of $7bn)

Notre Dame Intermedica (Sales of $2.4bn, market capitalisation of $5.3bn)

We have met both Hapvida and Notre Dame Intermedica, two of the leading private healthcare plan providers in Brazil. With a 25% penetration rate, the private sector is still underdeveloped. It has been affected by the economic recession since 2014 as the system is mostly financed by corporates. The sector is also under huge cost pressure as a result of strong and recurrent medical cost inflation (17-18% pa). However, as a result of poor public services (due to budget constraint), the development of a private alternative is inevitable. In this environment, large vertically integrated groups such as Hapvida and Notre Dame that operate low-cost business models and own healthcare facilities have important competitive advantages. They can face both high medical inflation and low reliability of third-party hospitals (30% more expensive because of volume-based billing system). Despite of the economic downturn in the past years, these two groups generate strong growth thanks to market consolidation (780 players in 2017 vs. 1200 in 2007). Should there be economic recovery and subsequent job creation, they are well positioned to accelerate their organic growth.

We have met both Hapvida and Notre Dame Intermedica, two of the leading private healthcare plan providers in Brazil. With a 25% penetration rate, the private sector is still underdeveloped. It has been affected by the economic recession since 2014 as the system is mostly financed by corporates. The sector is also under huge cost pressure as a result of strong and recurrent medical cost inflation (17-18% pa). However, as a result of poor public services (due to budget constraint), the development of a private alternative is inevitable. In this environment, large vertically integrated groups such as Hapvida and Notre Dame that operate low-cost business models and own healthcare facilities have important competitive advantages. They can face both high medical inflation and low reliability of third-party hospitals (30% more expensive because of volume-based billing system). Despite of the economic downturn in the past years, these two groups generate strong growth thanks to market consolidation (780 players in 2017 vs. 1200 in 2007). Should there be economic recovery and subsequent job creation, they are well positioned to accelerate their organic growth.

Created in 1979, Hapvida offers healthcare plans (2.2M members) and dental plans (1.7M) to both corporate and individual clients. The group is controlled by the founding family (70%) and operates a vertically integrated business model since 2004. Through its network of 40 hospitals (2500 beds), 42 emergency centres, 160 clinics and 141 diagnostic units, Hapvida is almost self-sufficient (93%). The group has a low medical loss ratio of 62% vs. sector average of 81%. Historically dominant in the North and North East regions (24% and 30% of ms respectively), Hapvida has accelerated its development in new regions through recent acquisitions of Sao Francisco and Grupo America. These operations are interesting as they bring both growth (1M new members) and synergies but the group still needs to prove its capacity in terms of integration in new regions. A s of Notre Dame Intermedica, a competitor controlled by Bain Capital (20%), the group is vertically integrated at 71% and also has a lower than sector average medical loss ratio (75%). As a dominant player in the state of Sao Paulo (15% ms), Notre Dame has higher exposure to corporate clients (95% of its members vs. 73% for Hapvida), an attractive segment thank to a less strict regulatory requirement (flexible pricing,possibility to end non profitable contracts).

s of Notre Dame Intermedica, a competitor controlled by Bain Capital (20%), the group is vertically integrated at 71% and also has a lower than sector average medical loss ratio (75%). As a dominant player in the state of Sao Paulo (15% ms), Notre Dame has higher exposure to corporate clients (95% of its members vs. 73% for Hapvida), an attractive segment thank to a less strict regulatory requirement (flexible pricing,possibility to end non profitable contracts).

Regarding their financials, both groups have strong balance sheet and enjoy net cash position. Notre Dame trades at a 2020 PER of 29x and EV/EBITDA of 14x vs. 27x and 15x respectively for Hapvida justified by higher historical growth.However, the consensus could underestimate the earning growth of Hapvida (estimated at 19% this year and 29% in 2021) as its synergies with Sao Francisco could be greater than expected.

STOCK FOCUS

Stock Focus: BTG Pactual (Revenue of $2bn, market capitalisation of $6bn, 0.8% of GemEquity)

The financial group BTG Pactual was created in 1983 in Rio de Janeiro. Has been weakened by the economic recession and alleged charges against its former President, André Esteves for his involvement in the “Lava Jato” scandal (acquitted in 2018), the bank nicknamed “Better Than Goldman - BTG” is back in full force, helped by a better macro environment and motivated employees (who controls 76.5% of the bank through a meritocratic partnership). At our meeting in Sao Paulo, President Roberto Sallouti expected the Brazilian economic recovery to accelerate and all bank activities to benefit.

The financial group BTG Pactual was created in 1983 in Rio de Janeiro. Has been weakened by the economic recession and alleged charges against its former President, André Esteves for his involvement in the “Lava Jato” scandal (acquitted in 2018), the bank nicknamed “Better Than Goldman - BTG” is back in full force, helped by a better macro environment and motivated employees (who controls 76.5% of the bank through a meritocratic partnership). At our meeting in Sao Paulo, President Roberto Sallouti expected the Brazilian economic recovery to accelerate and all bank activities to benefit.

At first, investment banking division should continue to outperform. The number of IPOs in 2020 should be at least as numerous as last year although 2019 was a year of record. The growth of corporate lending should accelerate to reflect better business climate with same credit quality. Increased transaction volumes at Brazilian financial markets are in favour of its sales & trading division. The group has also made progress in asset management division thanks to the digitalization of its platform and market share gain vis-à-vis universal banks.

As to the development of BTG Digital, the retail investors dedicated trading and online wealth management platform, management remained discreet for competitive reasons. However, “all the operating objectives for 2019” have been achieved. It is also interesting to pinpoint that XP, one of the rare competitors of BTG Digital listed in December 2019 has already a market capitalization of $10bn!

After its recent correction, the share trades at 2020 PER of 7x and P/B of 1.3x. The bank is sufficiently capitalized: its Tier 1 Capital ratio is at 12%. Its ROE is at 18% with potential upside but BTG prefers to give priority to investment (2% of ROE, mostly for BTG Digital).