Last month we spent several days discussing with Brazilian companies visiting London and Paris.

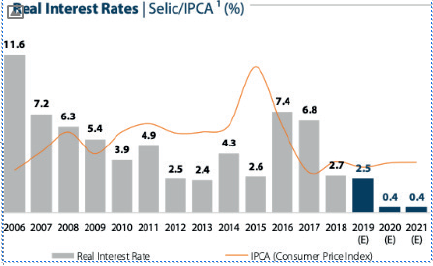

We met with major banks Itau Unibanco, Bradesco, BTG Pactual, car rental companies Localiza and Movida, gas station operator Ultrapar, university operator Yduqs (ex Estacio). Market performance has been stellar this year with iBovespa up +29% YTD in BRL and up +23% in USD. Interest rates have been cut 200 bps since January (-240bps for 10y bonds), to all time low 4.5% (2% in real terms, cf. chart below). It triggered domestic funds switch from fixed income to equities, buying the market on any pullback. Total domestic funds AUM reached $1,1tr, of which 12% are invested in equities (vs. a peak of 22% in 2007 and an average of 13% over the last 15 years). It includes $220bn AUM of pension funds, 18% invested in equities (vs. 30% on average over 2004-10). 2019 also marks a record year for IPOs with $27bn being raised YTD.

Brazil is the 6th largest global economy with 210M inhabitants and $2tr GDP.

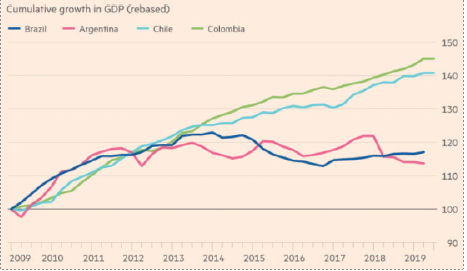

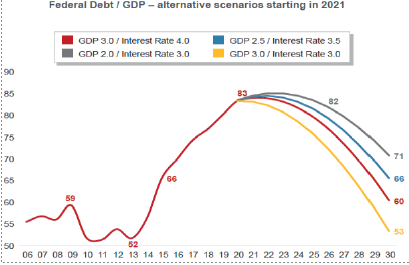

After a stagnant decade (barely better than Argentina, cf. chart below) and growing below 1% over the last 3 years (as negatively impacted by the withdrawal of public funding perfusion), the Brazilian economy should finally rebound in 2020. Public development bank BNDES disbursements dropped from R$250bn annually during 2009-2014 to R$70bn in 2018. During the Itau conference in London and for the first time, we heard a member of the Ministry of Economy mentioning an internal target of 3% GDP growth for next year. Consensus is currently at 2.2-2.5%. We strongly believe the expected rebound will happen. On one hand, the public sector spending will continue to decline but possibly at a slower pace than in the last 3 years. On the other hand, the private sector is expected to be boosted by improved business confidence and should grow over 3% pa. Pension reform is now voted, playing in favor of lower long-term neutral interest rate due to lower country risk premium. The government escapes the dangerous future debt escalation but needs the economy to grow for the deleveraging to play out (cf. chart below).

After a stagnant decade (barely better than Argentina, cf. chart below) and growing below 1% over the last 3 years (as negatively impacted by the withdrawal of public funding perfusion), the Brazilian economy should finally rebound in 2020. Public development bank BNDES disbursements dropped from R$250bn annually during 2009-2014 to R$70bn in 2018. During the Itau conference in London and for the first time, we heard a member of the Ministry of Economy mentioning an internal target of 3% GDP growth for next year. Consensus is currently at 2.2-2.5%. We strongly believe the expected rebound will happen. On one hand, the public sector spending will continue to decline but possibly at a slower pace than in the last 3 years. On the other hand, the private sector is expected to be boosted by improved business confidence and should grow over 3% pa. Pension reform is now voted, playing in favor of lower long-term neutral interest rate due to lower country risk premium. The government escapes the dangerous future debt escalation but needs the economy to grow for the deleveraging to play out (cf. chart below).  Fiscal deficit is stretched at 6.5% of 2019 GDP (non-discretionary mostly), so it needs to create favorable conditions for the private sector to accelerate. Finance Minister Paulo Guedes wants to further reduce the size of the state, cut the number of municipalities, process with tax reform (key!), reduce import tariffs (by half starting from 2020), attract FDI and overall improve the business environment. The government is currently on the right track. But there is still this risk of disagreement between President Bolsonaro (more populist) and Finance Minister Guedes (more orthodox).

Fiscal deficit is stretched at 6.5% of 2019 GDP (non-discretionary mostly), so it needs to create favorable conditions for the private sector to accelerate. Finance Minister Paulo Guedes wants to further reduce the size of the state, cut the number of municipalities, process with tax reform (key!), reduce import tariffs (by half starting from 2020), attract FDI and overall improve the business environment. The government is currently on the right track. But there is still this risk of disagreement between President Bolsonaro (more populist) and Finance Minister Guedes (more orthodox).

Sector Focus: Banking industry

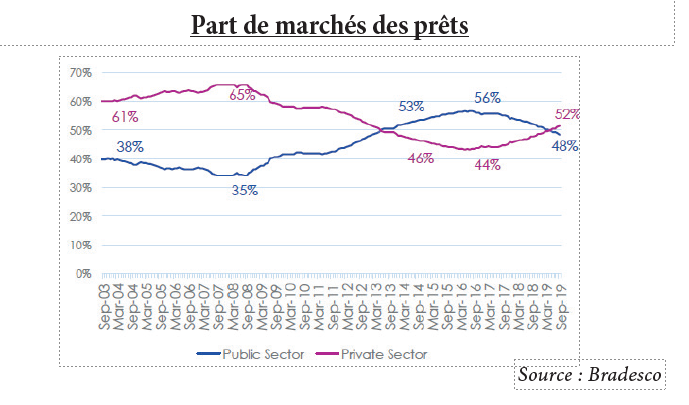

Financial industry in Brazil is dominated by 5 major banks with assets of $1.5tr. In terms of loans since the peak of the crisis in 2016, public banks (Banco do Brazil, Caixa and BNDES) have been losing ground to private banks. The latter now control 52% of loans in the system (vs. 44% in 2016 and 65% in 2008) and recorded credit growth of over 14% in 3Q19 (vs. negative -2% for public banks).

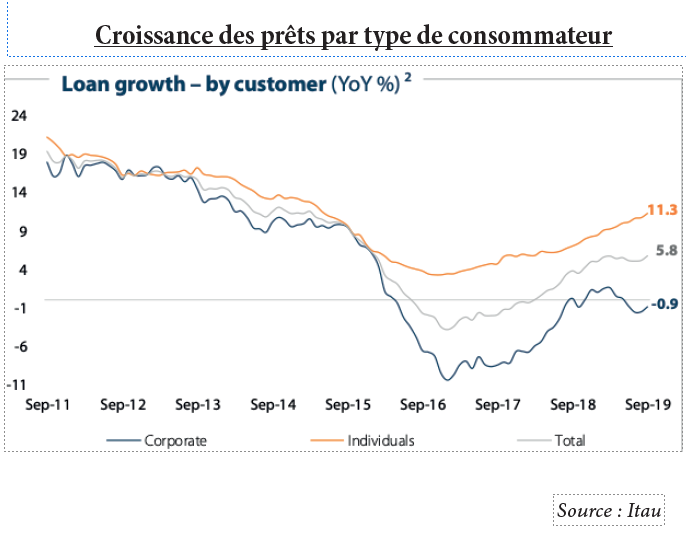

Corporate segment is still lagging, seating on excess capacity (75% utilization rate in the system) and waiting for the economy to recover. However individuals have been leveraging up and retail loans have been growing at double digit rate as shown in the chart below. In terms of asset quality, bad debt formation peaked in 2016 and has been on a downtrend ever since reaching 3.4% of loans in 2019 for the system. Meanwhile the system deleveraged with credit-to-GDP dropping from 53% in 2015 to 48% in 3Q19. The decline is even more pronounced for corporate segment: the ratio reached 20% in 3Q19 vs. 28% in 2015.

In that favorable environment, boosted by all time low interest rates, leading private banks were expected to perform well. However it has not been the case in 2019. The reason is the intensifying competition from new comers in digital banking and acquiring business. As a result fees grew low single digit as of 9M19 (31% of revenue for Itau and 32% for Bradesco). Subsequently, banks invested massively in IT to rush with their digital solutions and added another layer of cost cutting initiatives (each laid off 3,500 people in 2019 and closed branches). This dynamic pressured both revenue and earnings growth. Regulator added additional layers of pressure by 1/ announcing a cap on overdraft rates of 8% late November and 2/ pension reform vote resulted in reversal of statutory tax rate back to 45% in 2020 from 40% in 2019. Both measures can negatively impact banks earnings by 7-8% in 2020. At this stage, we believe these are the last overhangs on the banks’ stock performance.

Stock Focus: Itau (assets of $388bn, revenue of $27bn, market capitalization of $79bn; 2% of GemEquity)

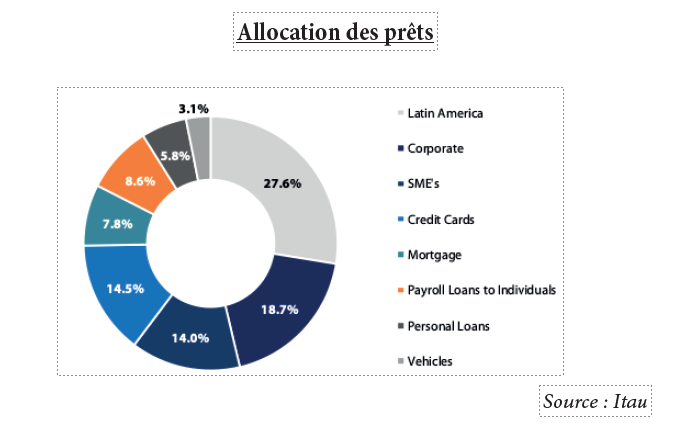

Itau Unibanco is the largest private bank in Latin America resulting from a merger between Banco Itau and Unibanco in 2008. The first was founded in 1943 in Sao Paulo by de Souza Aranha family and the second in Minas Gerais in 1923 by Salles family. Within ten years the size of the bank tripled compared to the combined size of the two entities in 2008 and reached $388bn in assets as of 3Q19. Founding families control 26% of the capital but under the reigns of CEO Candido Bracher the company is run by professionals. Bank generates 90% of revenue and 95% of profit out of Brazil as of 9M19. It is present in Chile, Mexico, Colombia to name a few, where 28% of the loan book is landed. The bank relies on a network of 4,700 branches and 55M clients as of 3Q19. Deposits represent 48% of interest-bearing liabilities hence cost of funds is fairly attractive. Loans only represent 32% of Itau assets ($130bn book), followed by securities and derivatives for 29% and cash & interbank investments for another 29%.

Itau Unibanco is the largest private bank in Latin America resulting from a merger between Banco Itau and Unibanco in 2008. The first was founded in 1943 in Sao Paulo by de Souza Aranha family and the second in Minas Gerais in 1923 by Salles family. Within ten years the size of the bank tripled compared to the combined size of the two entities in 2008 and reached $388bn in assets as of 3Q19. Founding families control 26% of the capital but under the reigns of CEO Candido Bracher the company is run by professionals. Bank generates 90% of revenue and 95% of profit out of Brazil as of 9M19. It is present in Chile, Mexico, Colombia to name a few, where 28% of the loan book is landed. The bank relies on a network of 4,700 branches and 55M clients as of 3Q19. Deposits represent 48% of interest-bearing liabilities hence cost of funds is fairly attractive. Loans only represent 32% of Itau assets ($130bn book), followed by securities and derivatives for 29% and cash & interbank investments for another 29%.

Loan book is diversified. Large corporates exposure dropped significantly in Brazil since 2015 first driven by the economy slowing down and more recently by the emergence of cheap funding alternative due to low interest rates. Meanwhile credit cards and SME have been expanding, sustaining the NIM given their higher spreads. As of 9M19, what is called Financial Margin with Clients increased 7.5%. However, given the decline in interest rates Financial Margin with the Market line dropped -8.4% in Brazil (-1.6% on consolidated basis). It only represents 7% of interest income as of 9M19 and used to be 10% in 2016 when SELIC reached 14% mark. But profitability is higher given that no provision is required in front. As the biggest cut in rates has already been done, starting from 2020 this line should not decline any more. Targeting higher income retail customers along with institutional clients, Itau has developed strong asset management, insurance and investment banking arms. Fees represent 31% of Itau operating income, growing 4% in 9M19. Asset management fees are up 16.5% YTD (12% of fee revenue), advisory & brokerage +65% (5% of the mix), card issuance +6.1% (21% of the mix) but acquiring fees (9% of the mix) are down 18.5%. Meanwhile current account services are up only +1.7% (18% of the mix). This situation is a perfect illustration of the Brazilian competitive environment and Itau management’s response. They had to align with new entrants Pag Seguro and Stone on acquiring business but counterbalanced thanks to their strong retail franchise. Card payments penetration in Brazil is low, at 40% of the system and is expected to grow 12% CAGR in the next 5 years. Credit card loans accelerated to +21% and personal loans to +20% in 3Q19 for Itau, highlighting strong potential going into 2020.

Regarding their digital strategy, 80% of payments and 47% of investments are already done digitally. This year Itau launched a pure mobile banking platform named ITI for individual clients with no minimum income or bank account requirements and open virtual wallets. The bank wanted to go digital earlier as it tried to acquire low cost online retail brokerage house XP Inc. back in 2017. The anti-trust body only allowed for a 49.9% stake. The company just got listed on Nasdaq, raising $2bn and being valued $15bn (vs $3bn in 2017, at 4.15BRL/USD).

The management expects loan growth to accelerate to 9-11% mark for the system in 2020. The bank generates 23% ROE with healthy TIER 1 of 13.5%. The bank has also developed a strong sustainability policy and communication: employee turnover is low at 10%, 52% of labor force are women and 22% are black people. The stock is valued at a P/BV of 2.5x, a 2020 PER of 12x and offers a dividend yield of 5.5%. Since summer 2019, GemEquity has built up a position to currently 2% of the portfolio.