In the month of November, we returned to India after visiting the country in November 2018 and June 2019 (cf. our previous travel books).

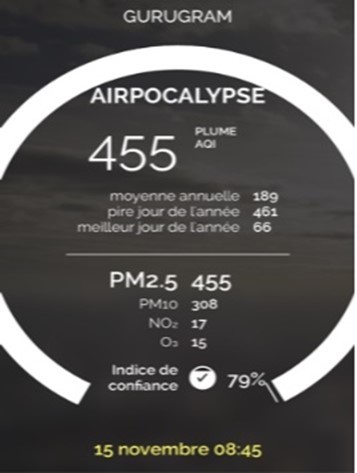

In order to better understand the impact of a slowing economy and the dynamics post Diwali we have started our journey in Ahmedabad, Gujarat (6m inhabitants, in Narendra Modi’s home state) and Delhi where we have met 8 small and medium-sized companies from different sectors. We then participated at the investor conference (200 investors, 80 companies) organized by CLSA in Gurgaon, the satellite city of Delhi also known for its heavy pollution. During our visit, concentration of fine particulate matter (PM2.5) increased to 455 which is 18x higher than the WHO guideline level. We have also spent 2 days in Mumbai, the business center of the country.

In summary, in 9 days, we have met 31 companies including the jewelry group Titan (0.5% of GemEquity), the conglomerate Reliance Industries; IT service leaders TCS, Infosys, HCL; financial groups HDFC (1% of GemEquity), HDFC Bank (1% of GemEquity), Axis Bank and HDFC Asset Management; insurance leaders HDFC Life, ICICI Pru Life and ICICI Lombard; the piping companies Astra Poly Technik and Supreme Industries; industrial companies Havells and Amber Group; agribusiness companies Godrej Agrovet and UPL; construction company Larsen & Toubro; the largest movie multiplex player PVR; the leading mall operator Phoenix Mills and pharmaceutical group Sun Pharma.

Overall, business leaders sound cautious.

The continuous economic deceleration remains their major concern. One year after the collapse of IL&FS

(AAA rated), the confidence has not yet been restored for most of the NBFCs (Non-banking financial companies, 20% of financial system). The subsequent increased in funding cost weights on the credit growth and therefore the whole economy, just as we expected (cf. our travel book in November 2018). Different reform measures (demonetization, introduction of GST) that are structurally positive in the long run, have created huge pressure on informal sector (45% of GDP and 75% of jobs).

in the long run, have created huge pressure on informal sector (45% of GDP and 75% of jobs).  The weak rural economy (used to grow at 2x the urban sector) also affects general sentiment. However, some business leaders have noted a slight improvement of demand during the festival of Diwali (a view far from being shared by most companies), backed by promotional activities and targeted credit offers.

The weak rural economy (used to grow at 2x the urban sector) also affects general sentiment. However, some business leaders have noted a slight improvement of demand during the festival of Diwali (a view far from being shared by most companies), backed by promotional activities and targeted credit offers.

Government’s recent initiatives (lower corporate taxes rates from 30% to 22%, launch of a real estate fund to save stalled residential projects, etc.) and supportive monetary measures (interest rates cuts of 135 bps ytd) are positively perceived. But in an environment of weak demand and low utilization rate (75% for the moment), most companies prefer to wait before making any meaningful investment.

Macro Focus: Toward a gradual recovery?

At the macro level, the slowdown we observed in the beginning of the year has further deteriorated. The economic growth has dropped to 5% in June and the RBI (central bank) has revised its annual forecast for current fiscal year to 6.1% vs. 7% initially and 8% recorded last year.  On the field, both consumer and business sentiment is weak. Should this pessimism be well justified, we have however noticed some encouraging improvement : First of all, the monetary environment is supportive. After increased repo rate to 6.5% in August 2018 (a misstep), the RBI has cut the rates 5 times this year (135 bps in total) but still has room for further cuts as current higher inflation is expected to be temporary (driven by higher vegetable prices as a result of supply disruption post monsoon). The transfer mechanism toward real economy should improve gradually thanks to public sector banks capitalization (we don’t expect fast progress) and the introduction of repo-linked interest rates in lending. As to the NBFC crisis, RBI’s takeover of Dewan Housing Finance Corp (a large player in the mortgage market on the verge of bankruptcy) and the creation of a fund to save stalled residential projects should help relieve general stress. Property sales values across the top 8 cities have increased by 12% ytd. The momentum of pre-sales across major developers are showing positive trends. As a matter of fact, best quality NBFCs have already seen a “normalization” of funding costs. We also appreciate the corporate tax rates cut and further liberalizing of foreign direct investment rules. At last, the privatization of state assets should ease some fiscal pressure for the government who has fixed its fiscal deficit target at 3.3% of GDP.

On the field, both consumer and business sentiment is weak. Should this pessimism be well justified, we have however noticed some encouraging improvement : First of all, the monetary environment is supportive. After increased repo rate to 6.5% in August 2018 (a misstep), the RBI has cut the rates 5 times this year (135 bps in total) but still has room for further cuts as current higher inflation is expected to be temporary (driven by higher vegetable prices as a result of supply disruption post monsoon). The transfer mechanism toward real economy should improve gradually thanks to public sector banks capitalization (we don’t expect fast progress) and the introduction of repo-linked interest rates in lending. As to the NBFC crisis, RBI’s takeover of Dewan Housing Finance Corp (a large player in the mortgage market on the verge of bankruptcy) and the creation of a fund to save stalled residential projects should help relieve general stress. Property sales values across the top 8 cities have increased by 12% ytd. The momentum of pre-sales across major developers are showing positive trends. As a matter of fact, best quality NBFCs have already seen a “normalization” of funding costs. We also appreciate the corporate tax rates cut and further liberalizing of foreign direct investment rules. At last, the privatization of state assets should ease some fiscal pressure for the government who has fixed its fiscal deficit target at 3.3% of GDP.

Stock Focus: ICICI Lombard (Net Premium earned: $1.6bn, market capitalization of $8.5bn), HDFC Life (Net Premium earned $4bn, market capitalization of $16bn, ICICI Pru Life (Net Premium earned $7bn, market capitalization of $10bn)

We have met ICICI Lombard (general insurance), HDFC Life and ICICI Pru Life (life insurance), 3 industry leaders from the private sector. ICICI Lombard CEO Bhargav Dasgpupta, believes in the growth opportunities of the industry, despite the decline of auto sales.

We have met ICICI Lombard (general insurance), HDFC Life and ICICI Pru Life (life insurance), 3 industry leaders from the private sector. ICICI Lombard CEO Bhargav Dasgpupta, believes in the growth opportunities of the industry, despite the decline of auto sales.

The premium growth could be reduced to 15% pa vs. 20% in the past. However, he expects better awareness about insurance as India’s increased GDP per capita (which has just reached the inflexion point of US$2,000). This growth should be supported by the poor penetration (general insurance premium / GDP at 0.9% vs. 2% in China) and favorable regulation (longer tenure of 3 years for cars and 5 years for 2 wheelers). To cope with a highly competitive environment where state-owned larger players (c50% of market share, but in decline) operate with aggressive behavior, ICICI Lombard prefers to give priority to return. Thanks to this strategy and a prudent management, the group has a low share of calamity losses at 3% vs industry’s 8-9%.  Furthermore, the group has recently decided to withdraw from crop insurance as a result of higher loss ratio and higher reinsurance commission. The management sees the release of reserves that have been accumulated over the past 6 years. Regarding life insurance industry, it also offers a similar structural growth outlook. HDFC Life and ICICI Pru Life both enjoy strong bancassurance channel (c55% of mix). However, they are actively developing their own direct distribution capacities in order to reduce distribution cost and to have a hedge should banks adopt open architecture (HDFC Bank has already opened its platform; ICICI Pru on the other hand, does not expect ICICI Bank to do the same any time soon). With 21% of premium generated by direct channel, HDFC has a considerable lead in this development (vs. 12% for ICICI Pru). In an environment of declining interest rates which weight on insurance companies’ profitability (exposed to guaranteed return products), HDFC is best positioned as 43% of its mix already consists of protection products (vs 15% for ICICI Pru).

Furthermore, the group has recently decided to withdraw from crop insurance as a result of higher loss ratio and higher reinsurance commission. The management sees the release of reserves that have been accumulated over the past 6 years. Regarding life insurance industry, it also offers a similar structural growth outlook. HDFC Life and ICICI Pru Life both enjoy strong bancassurance channel (c55% of mix). However, they are actively developing their own direct distribution capacities in order to reduce distribution cost and to have a hedge should banks adopt open architecture (HDFC Bank has already opened its platform; ICICI Pru on the other hand, does not expect ICICI Bank to do the same any time soon). With 21% of premium generated by direct channel, HDFC has a considerable lead in this development (vs. 12% for ICICI Pru). In an environment of declining interest rates which weight on insurance companies’ profitability (exposed to guaranteed return products), HDFC is best positioned as 43% of its mix already consists of protection products (vs 15% for ICICI Pru). ICICI Pru decides to stay away from guaranteed return products while HDFC on the other hand, chooses to maintain this type of offer. It is also worth noting that the fast development of online policy aggregators such as Policy Bazaar (10% owned by Chinese Tencent) which could lead to intensified competition at the distribution level.

ICICI Pru decides to stay away from guaranteed return products while HDFC on the other hand, chooses to maintain this type of offer. It is also worth noting that the fast development of online policy aggregators such as Policy Bazaar (10% owned by Chinese Tencent) which could lead to intensified competition at the distribution level.

Stock Focus: Supreme Industries (Sales of $840m, market capitalization of $2bn), Astra Poly Technik (Sales of $420m, market capitalization of $2.4bn)

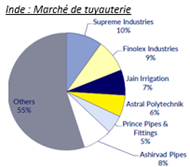

Supreme Industries and Astra Poly Technik are 2 leading pipe manufacturers in India. Supreme has diversified activities: other than pipes (56% of sales), the company is also active in packaging (protective canvas, 21%), small components used by appliance manufacturers components used and plastic furniture. The company serves 3 types of piping customers: Public works (60%), agriculture (35%) and industrial (5%). Supreme is the market leader with the most diversified portfolio (>7,000 SKUs in pipes) and more than 30% of its mix is considered value-added products. It has 420,000 T of manufacturing capacity and also a national distribution network (3,400 distributors). As to Astra Poly, the group is one of Supreme Industries’ key competitors in pipe business (220,000 T of capacity). It supplies building & public works (85%) and industrials (15%).

Supreme Industries and Astra Poly Technik are 2 leading pipe manufacturers in India. Supreme has diversified activities: other than pipes (56% of sales), the company is also active in packaging (protective canvas, 21%), small components used by appliance manufacturers components used and plastic furniture. The company serves 3 types of piping customers: Public works (60%), agriculture (35%) and industrial (5%). Supreme is the market leader with the most diversified portfolio (>7,000 SKUs in pipes) and more than 30% of its mix is considered value-added products. It has 420,000 T of manufacturing capacity and also a national distribution network (3,400 distributors). As to Astra Poly, the group is one of Supreme Industries’ key competitors in pipe business (220,000 T of capacity). It supplies building & public works (85%) and industrials (15%).  The group is a CPVC pipe expert (55% of sales, used in cold/hot water distribution). This small segment is growing nicely but is challenged by Chinese and Korean competition. However, the anti-dumping duty implemented by the government last August offered some relief to domestic players.

The group is a CPVC pipe expert (55% of sales, used in cold/hot water distribution). This small segment is growing nicely but is challenged by Chinese and Korean competition. However, the anti-dumping duty implemented by the government last August offered some relief to domestic players.  Although the industry has been affected by weak macro environment (2/3 of demand from new projects), both Supreme and Astra have enjoyed strong volume growth (+21% vs. +5% for the industry). Unorganized players that represent 50% of the market have been weakened by the government structural reforms. The liquidity crisis started September 2018 has accelerated consolidation. Both Supreme and Astra enjoy an almost debt-free BS. Their profit abilities are excellent (ROE at 21%). Astra trades at a 03/21 PER of 45x vs. 25x for Supreme as a result of its higher exposure to CPVC pipes (better pricing), absence from agriculture sector (suffers because of weak growth) and the turnaround of its distribution network.

Although the industry has been affected by weak macro environment (2/3 of demand from new projects), both Supreme and Astra have enjoyed strong volume growth (+21% vs. +5% for the industry). Unorganized players that represent 50% of the market have been weakened by the government structural reforms. The liquidity crisis started September 2018 has accelerated consolidation. Both Supreme and Astra enjoy an almost debt-free BS. Their profit abilities are excellent (ROE at 21%). Astra trades at a 03/21 PER of 45x vs. 25x for Supreme as a result of its higher exposure to CPVC pipes (better pricing), absence from agriculture sector (suffers because of weak growth) and the turnaround of its distribution network.