This September, half of Gemway’s investment team travelled to Hong Kong and China (Shanghai, Guangzhou and Shenzhen).

First, we participated in the traditional CLSA investor conference in Hong Kong (1,200 investors, 310 companies, about 20% fewer participants due to the Hong Kong demonstrations) and met there 38 Asian companies: 24 Chinese, including China Mobile and China Unicom, with whom we discussed the rising of 5G; 5 Taiwanese (TSMC (5% of GemEquity, our major 5G beneficiary), Mediatek (design of semiconductor chips), Yageo (passive components), Giant Manufacturing (bicycles) and Airtac (industrial automation) and also some Korean companies such as Samsung Biologics, SEMCO (passive components) and the two battery manufacturers LG Chem and Samsung SDI. Undoubtedly, China is on the way to accelerate the development of 5G, which is positive for many technology companies like TSMC. It also wants to internalize technology in order to reduce its dependence on foreign companies in the long term.

We also held discussions with various field experts (economists, international relations specialists, experts in new technologies, etc...).

At the macro level, the two main topics discussed were Sino-American tensions and the political situation in Hong Kong.

On the first subject, former Australian Prime Minister Kevin Rudd (2007-2010, 2013), currently President of the Asian Society Policy Institute in New York and a leading expert on China (fluent in Mandarin) shared his analysis with us. According to him, President Xi Jinping’s central objective is to strengthen the CCP’s power in the run-up to its centenary in 2021. To achieve this, the Party must deliver on stable economic growth and the gradual rise of Chinese people’s standard of living. In the shorter term (by the end of the year), Mr. Rudd expects a minimum agreement between China and the United States. His argument is economic pragmatism. Indeed, the two global giants are slowing down and the current trade uncertainty increases recession risks in 2020. Moreover, John Bolton’s departure from the American government favors the path of conciliation. On the other hand, this optimism does not seem to be shared by most investors we met. The subject therefore remains sensitive and the market uncertain. Also, any progress towards an agreement would definitely be taken positively. On the second subject, there is undeniably a feeling of confusion.  Our Hong Kong contacts, permanent residents of the Special Economic Zone, are relatively pessimistic and believe that the situation will continue and have a lasting impact on the local economy. Some even sees it as the CIA’s hand to push Beijing to intervene militarily and thereby discredit itself diplomatically. From our perspective, we see it as a certain identity crisis. Young Hong-Kongers have difficulties seeing their future in China as a whole (very high real estate price, reduced job opportunities due to Mainland Chinese competition, etc...). Many of them do not feel they are part of China. Of course, one should not forget that the relative importance of the territory has been considerably reduced. From 28% of China’s GDP in 1997, Hong Kong’s weight is now about 2.5%. In view of China’s strong growth, this transition was inevitable and should inevitably continue. From Beijing’s point of view, they are surprised by the «spoiled children» behavior of the young demonstrators and prefer not to intervene for the moment, leaving it to the local authorities to solve the problem, which they have great difficulty doing (see the extradition law finally abandoned). In the meantime, the local impact is real. Restaurants are often empty, and shops deserted, Chinese tourists are absent. Also, the economy already affected by US China trade tensions now struggles with two problems. It is advisable to be cautious in the short term about real estate, whose prices are for the time being little affected.

Our Hong Kong contacts, permanent residents of the Special Economic Zone, are relatively pessimistic and believe that the situation will continue and have a lasting impact on the local economy. Some even sees it as the CIA’s hand to push Beijing to intervene militarily and thereby discredit itself diplomatically. From our perspective, we see it as a certain identity crisis. Young Hong-Kongers have difficulties seeing their future in China as a whole (very high real estate price, reduced job opportunities due to Mainland Chinese competition, etc...). Many of them do not feel they are part of China. Of course, one should not forget that the relative importance of the territory has been considerably reduced. From 28% of China’s GDP in 1997, Hong Kong’s weight is now about 2.5%. In view of China’s strong growth, this transition was inevitable and should inevitably continue. From Beijing’s point of view, they are surprised by the «spoiled children» behavior of the young demonstrators and prefer not to intervene for the moment, leaving it to the local authorities to solve the problem, which they have great difficulty doing (see the extradition law finally abandoned). In the meantime, the local impact is real. Restaurants are often empty, and shops deserted, Chinese tourists are absent. Also, the economy already affected by US China trade tensions now struggles with two problems. It is advisable to be cautious in the short term about real estate, whose prices are for the time being little affected.

We then continued our trip to China where we visited 13 companies in their headquarters (Shanghai, Guangzhou, Shunde, Zhongshan and Shenzhen) and participated in the China International Industry Fair in Shanghai, an exhibition of new technologies applied to industry. Many Chinese companies had their stand there. We were able to appreciate the progress made in 5G, automation, laser cutting and robots. Undoubtedly, the emergence of Chinese techno champions is underway and Sino-US tensions seem to accelerate this movement of «internalization».  In Shanghai, we visited new Internet companies such as Bilibili (video sharing site like Youtube, created in 2010), Baozun (created in 2007, a service company that helps enterprises with their strategy: e-commerce marketing, distribution, logistics) and Pinduoduo (created in 2015, now the 3rd e-commerce site after Alibaba and JD.com, specialized in low-cost sales). We also met Wuxi Biotech, a Chinese leader in biotechnology. In Guangdong and Shenzhen, we visited Baoyunport (the operator of Guangzhou Airport), Sofieya Home (custom-made furniture), Jonjee High tech (soy sauce), Midea (white goods and owner of German robot manufacturer Kuka), Tencent Music (Chinese Spotify), Han’s Laser (laser cutting machines), Ping An Group (2nd Chinese insurance group), Kingdee (ERP-type software supplier).

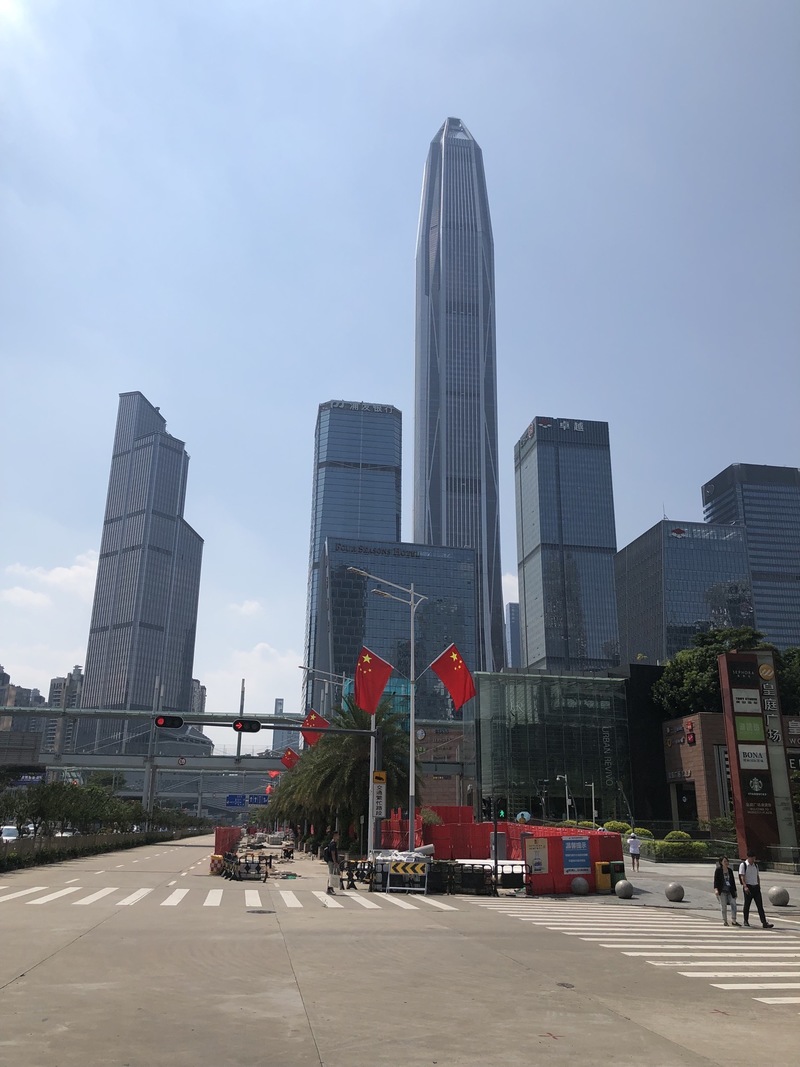

In Shanghai, we visited new Internet companies such as Bilibili (video sharing site like Youtube, created in 2010), Baozun (created in 2007, a service company that helps enterprises with their strategy: e-commerce marketing, distribution, logistics) and Pinduoduo (created in 2015, now the 3rd e-commerce site after Alibaba and JD.com, specialized in low-cost sales). We also met Wuxi Biotech, a Chinese leader in biotechnology. In Guangdong and Shenzhen, we visited Baoyunport (the operator of Guangzhou Airport), Sofieya Home (custom-made furniture), Jonjee High tech (soy sauce), Midea (white goods and owner of German robot manufacturer Kuka), Tencent Music (Chinese Spotify), Han’s Laser (laser cutting machines), Ping An Group (2nd Chinese insurance group), Kingdee (ERP-type software supplier).  In Guangzhou, the brand-new airport is a jewel of technology. Its theoretical capacity (80M passengers) as well as its current traffic (70M) is similar to Paris CDG. In Shenzhen, one can only admire the economic miracle of this special economic zone. The headquarters of Tencent, Ping An Insurance and many technology companies dominate the city center and contribute to unprecedented wealth creation. Shenzhen deserves its nickname, Chinese Silicon Valley.

In Guangzhou, the brand-new airport is a jewel of technology. Its theoretical capacity (80M passengers) as well as its current traffic (70M) is similar to Paris CDG. In Shenzhen, one can only admire the economic miracle of this special economic zone. The headquarters of Tencent, Ping An Insurance and many technology companies dominate the city center and contribute to unprecedented wealth creation. Shenzhen deserves its nickname, Chinese Silicon Valley.

Stock Focus: Mediatek (Sales of $8bn, market capitalization of $20bn)

Taiwanese electronic chip designer Mediatek, Qualcomm’s competitor, is one of the main winners of the proliferation of 5G in China. Paradoxically it also benefits from the Sino-American technology war as its solutions can be favored vs. its American peers by Chinese smartphone makers. 1/3 of the turnover comes from smartphones (3G solutions; 4G currently); 1/3 from innovative solutions (connected objects, smart speakers) and 1/3 from mature platforms (TV, 2G phones). When 4G was launched in 2014, not only Qualcomm was a year ahead of Mediatek in technology but it also adopted an attractive pricing policy to capture the Chinese smartphone market. Subsequently, Mediatek gross margin decreased from 48% in 2014 to 35% in 2016-17. Following this poor performance, Mediatek’s engineers worked hard to ensure that they did not miss the opportunity offered by 5G. The company invests 25% of its revenue in R&D. A successful bet because the first solution integrating modem and operating system (called System on Chip, SoC) will be available from 1Q20 at $60 (vs.$10 for the SoC 4G currently). It’s 40% cheaper than Qualcomm’s solution. Most of Mediatek’s customers are in China: Xiaomi, Oppo, Vivo. Huawei might join them later in 2020 as the company first favors its internal solution. Having received 5G licenses last June, Chinese telecom operators have been aggressive deploying the network. In 2019, it is expected that only 25 million 5G smartphones (out of 1.4bn) will be sold worldwide. A figure that is expected to increase tenfold in 2020 to 250M, 60% of which will come from Chinese brands. And there is a good chance that Mediatek will be one of the main beneficiaries. This will result in faster growth and better margins. The market currently expects 26% earnings growth in 2020, with a risk of upward revisions. It is still unclear what impact 5G can have on connected objects, the automotive industry and other innovative sectors (1/3 of Mediatek sales). The stock trades at a 2020 PER of 20x. Attractive.

Stock Focus: Luckin Coffee (sales of $700M, market capitalization of $5bn)

Ah, a coffee in China is worth it. Oh yea! Because without a mobile payment method, without an installed app, they weren’t going to serve us. Fortunately we were accompanied by a local contact. This is the sales strategy of the new entrant in the market, Luckin Coffee. Started in 2017 and listed in May 2019 (raised $645M), the company aims at reaching 4,500 points of sale by the end of 2019 (3,000 reached in 2Q19).  Stores are located on the ground floors of office buildings. The coffee market in China is close to $10bn, growing 30% per annum on average over the past 6 years. Chinese people drink an average 6 cups of coffee per year, well below the 200 cups consumed in Japan, a country with similar consumption habits. Needless to say, the growth potential is immense. The market is very fragmented in terms of number of points of sale: 120,000 in total according to Frost & Sullivan in 2018, of which only 5% are provided by branded chains such as Starbucks, Luckin, McCafé, Costa Coffee, Pacific Coffee. As can be seen below, Luckin’s growth has been spectacular. Before the opening of the first store, the company worked over a year on the development of its app. According to CEO Ms. Jenny Qian, 100 engineers followed her from her former employer CAR Inc (car rental company) and an additional 400 were quickly hired. The app is at the heart of the business model. It makes it possible to collect data on consumers’ purchasing habits, cross sell additional products (food, afternoon tea, etc...) and thus support the promotional activity.

Stores are located on the ground floors of office buildings. The coffee market in China is close to $10bn, growing 30% per annum on average over the past 6 years. Chinese people drink an average 6 cups of coffee per year, well below the 200 cups consumed in Japan, a country with similar consumption habits. Needless to say, the growth potential is immense. The market is very fragmented in terms of number of points of sale: 120,000 in total according to Frost & Sullivan in 2018, of which only 5% are provided by branded chains such as Starbucks, Luckin, McCafé, Costa Coffee, Pacific Coffee. As can be seen below, Luckin’s growth has been spectacular. Before the opening of the first store, the company worked over a year on the development of its app. According to CEO Ms. Jenny Qian, 100 engineers followed her from her former employer CAR Inc (car rental company) and an additional 400 were quickly hired. The app is at the heart of the business model. It makes it possible to collect data on consumers’ purchasing habits, cross sell additional products (food, afternoon tea, etc...) and thus support the promotional activity.  The average price of coffee currently is RMB16 ($2) vs. RMB30 ($4) for Starbucks. The company works with Louis Dreyfus and Mitsui for the supply of Arabica and buys coffee machines from Switzerland. Management plans to invest more in marketing in 2H19 to strengthen brand awareness. This is also the reason for the rapid deployment of physical points of sale. The company is still loss making but management is confident that it will turn profitable in 2020. The platform already has more than 20M active customers. A story to monitor.

The average price of coffee currently is RMB16 ($2) vs. RMB30 ($4) for Starbucks. The company works with Louis Dreyfus and Mitsui for the supply of Arabica and buys coffee machines from Switzerland. Management plans to invest more in marketing in 2H19 to strengthen brand awareness. This is also the reason for the rapid deployment of physical points of sale. The company is still loss making but management is confident that it will turn profitable in 2020. The platform already has more than 20M active customers. A story to monitor.

Stock Focus: Baozun (Sales of $1bn, market capitalization of $3bn)

Baozun is the showcase for Foreign brands on the Internet in China. Founded in 2007 in Shanghai and listed on NASDAQ in 2015, the company currently works with more than 200 brands in ready-to-wear, cosmetics, electronics, and furniture. Founders Mr. Vincent Qiu and Mr. Junhua Wu (6% of capital but 32% of voting rights) share the shareholding with renowned companies such as Alibaba (15% of capital, 7% of voting rights) and Softbank (12% and 7% respectively).  Baozun supports Alibaba’s ambition to promote $200bn in imports of foreign brands by 2023 on TMall in China. As the level of penetration is still low, growth has been very strong: gross merchandise value (GMV) has increased 55% over the last twelve months and stands at $6bn (12 months at the end of 1H19). Baozun service offering includes marketing strategy, virtual store management and storage solutions. The idea is to connect the brand with Chinese customer and help it grow. Baozun management plans to add 30 to 40 brands a year and expand the range of categories. In 2018, ready-to-wear accounted for 50% of the GMV and sports goods between 20 and 30%. We expect sales to grow on average 30% pa over the next 3 years, with 40% earnings growth. As the scale effect works in its favor, the operating margin should increase from 8% in 2018 to 13% by 2021. Return on equity is healthy, at 24%, and should also increase. The stock trades at a 2020 PER of 24x, attractive given the earnings growth.

Baozun supports Alibaba’s ambition to promote $200bn in imports of foreign brands by 2023 on TMall in China. As the level of penetration is still low, growth has been very strong: gross merchandise value (GMV) has increased 55% over the last twelve months and stands at $6bn (12 months at the end of 1H19). Baozun service offering includes marketing strategy, virtual store management and storage solutions. The idea is to connect the brand with Chinese customer and help it grow. Baozun management plans to add 30 to 40 brands a year and expand the range of categories. In 2018, ready-to-wear accounted for 50% of the GMV and sports goods between 20 and 30%. We expect sales to grow on average 30% pa over the next 3 years, with 40% earnings growth. As the scale effect works in its favor, the operating margin should increase from 8% in 2018 to 13% by 2021. Return on equity is healthy, at 24%, and should also increase. The stock trades at a 2020 PER of 24x, attractive given the earnings growth.