In June our compass pointed southeast. Following stellar performance registered by Narendra Modi BJP party during May 19, 2019 general elections, we were curious to get a sense of local sentiment and understand what is next for India.

Indeed, BJP managed to secure absolute majority at Lok Sabha (Lower House) and upcoming municipal elections for Rajya Sabha (Upper House) also look promising for Modi. All that in a context of economic slowdown and tight liquidity. After a day spent doing store checks in Mumbai, we attended Morgan Stanley conference. There were 500 investors and close to 90 companies, of which we met 21. We had interviews with leading private banks HDFC Bank, ICICI Bank, Kotak Bank and Axis Bank. In consumer space we met with auto players Maruti Suzuki, Ashok Leyland and Mahindra & Mahindra; white goods and electronics specialists Havells and Voltas; home decoration specialist Asian Paints; jewelry Titan Industries; specialized retailer Future Group. Among IT players we encountered with management teams of TCS, Infosys, HCL Tech and L&T Infotech. In real estate we met with India’s first listed REIT Embassy Commercial Property and developer Godrej Properties.

Overall the tone is cautiously optimistic.

Short term, liquidity squeeze has been impacting the economy and the sentiment. Local investors are particularly worried about systemic risk post NBFCs (non-banking financial corporations) fall out. Local rating agencies are no longer trusted. So, a general stress test is needed in order to understand what underlying assets are worth. In addition, some banks are in dire need of capital and cannot lend (YES Bank among private and most of public banks). The government response is dearly expected. Meanwhile companies with healthy balance sheets (top property developers and private banks) and ability to perform distress asset tests are in selective acquisition mode. In the long run everybody agrees that the economy will rebound. The question is WHEN rather than IF. Next government deadline is July 6, 2019 when FY03/20 budget will be announced by new Finance Minister, Ms. Nirmala Sitharaman. Investors are expecting more redistribution towards rural sector and announcement on public bank recapitalization.

Macro Focus: slowing economy

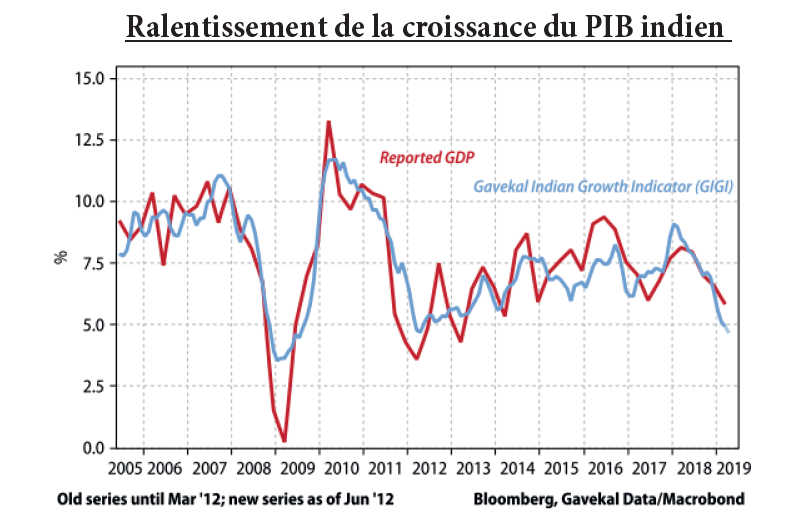

Modi’s 2nd 5-year term starts on a slow note. 1Q19 GDP growth is at 20-quarter low impacted by slowing consumption and lack of private capex rebound.

Monetary policy: Real rates are high (3%), oil prices remain rather low and Central Bank RBI has scope to lower REPO rates. But transmission mechanism is not straightforward in India. Because of high fiscal deficit and stretched balance sheets, monetary policy has limited effect. First since October 2018, nonfinancial banking institutions (NBFCs) are facing funding issues. They represent 20% of the financial system and were important contributors to past years loan growth, both in real estate and consumer discretionary. Second, 65% of banking industry consist of state owned banks who struggle to lend. Both segments need government intervention through assets stress tests (NBFCs) and recapitalization (banks). Meanwhile the top 4 private banks we met continue guiding for 20%+ loan growth this year. These leaders continue to consolidate the market and gain market shares. .

Monetary policy: Real rates are high (3%), oil prices remain rather low and Central Bank RBI has scope to lower REPO rates. But transmission mechanism is not straightforward in India. Because of high fiscal deficit and stretched balance sheets, monetary policy has limited effect. First since October 2018, nonfinancial banking institutions (NBFCs) are facing funding issues. They represent 20% of the financial system and were important contributors to past years loan growth, both in real estate and consumer discretionary. Second, 65% of banking industry consist of state owned banks who struggle to lend. Both segments need government intervention through assets stress tests (NBFCs) and recapitalization (banks). Meanwhile the top 4 private banks we met continue guiding for 20%+ loan growth this year. These leaders continue to consolidate the market and gain market shares. .

Investment: Private investment is still lagging with system utilization rates hovering around 75%. The government has been active deploying budget in public infrastructure. And the results are visible. But given high fiscal deficit (-4.5% of GDP), Indian government has limited firepower. It needs to privatize assets in order to raise money for new projects. Most of public infrastructure is currently operated by the government.So, in order to unlock growth, the government needs to solve financial stress situation, let public banks merge and launch a divestment/public asset monetization program.

Stock focus: HDFC Bank (revenue of $11bn; mar-ket capitalization of $95bn; 1% of GemEquity and GemAsia)

HDFC Bank is the leading private bank in India with $186bn worth of assets of which $126bn are loans. It was incorporated in 1994 by HDFC group, premier housing finance company that still controls 21% of capital. Mr. Aditya Puri joined then from Citigroup to fulfill the role of CEO and has built the best banking franchise in India. The bank has consistently been growing its earnings 25% CAGR over the last 25 years and has built a reputation of “graduate school” for the best managers in the financial industry. Mr Puri will turn 70 in October 2020 and as per current RBI regulation, he will have to step down. Hopes are that the rule will be changed, as it was done for RBI governors recently. Nevertheless, CFO Sashidhar Jagdishan reassures us highlighting the level of process institutionalization within the company: the succession plan is in making and they are open to international candidates. Mr. Jagdishan also unveiled the bank strategy that will drive its growth over the next decade. Today HDFC Bank has 49M customers. The network is rich of 5,100 branches, half of it being in rural and semi-urban areas.

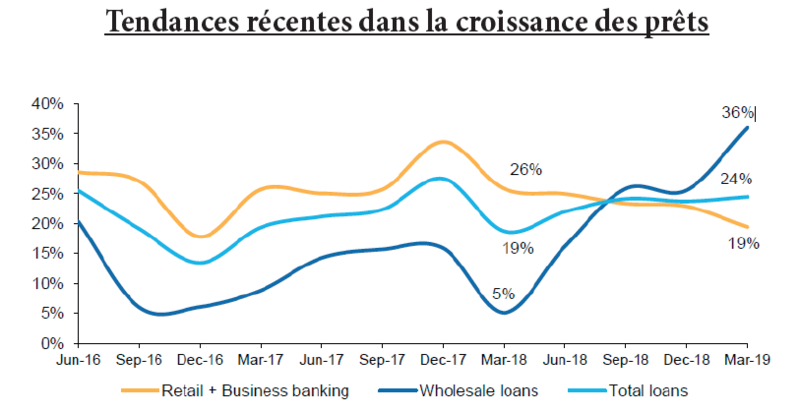

HDFC Bank is the leading private bank in India with $186bn worth of assets of which $126bn are loans. It was incorporated in 1994 by HDFC group, premier housing finance company that still controls 21% of capital. Mr. Aditya Puri joined then from Citigroup to fulfill the role of CEO and has built the best banking franchise in India. The bank has consistently been growing its earnings 25% CAGR over the last 25 years and has built a reputation of “graduate school” for the best managers in the financial industry. Mr Puri will turn 70 in October 2020 and as per current RBI regulation, he will have to step down. Hopes are that the rule will be changed, as it was done for RBI governors recently. Nevertheless, CFO Sashidhar Jagdishan reassures us highlighting the level of process institutionalization within the company: the succession plan is in making and they are open to international candidates. Mr. Jagdishan also unveiled the bank strategy that will drive its growth over the next decade. Today HDFC Bank has 49M customers. The network is rich of 5,100 branches, half of it being in rural and semi-urban areas.  The management focuses on going deeper in the countryside and plans to accelerate network expansion by adding 600-800 branches per annum over the next few years. Deposit growth (15-17% pa) has been lagging loan growth (20-25% pa) hence it needs to accelerate customer acquisition. In order to increase customer engagement and empower physical presence, the company elaborated virtual relationship management (VRM) system. Each VRM will cater 1500-1600 customers remotely. It also partnered with government to access its 0.3M common services centers across the country in order to cross sell asset and liability products for a fee. HDFC Bank’s product portfolio is among the most comprehensive offerings on the market. Their ambition is to be a one-stop shop platform for all type of customers: save, pay, invest, borrow, insure, shop/ecommerce. Apart from internally developed or acquired products, the bank also enjoys from group effect. HDFC Life Insurance and HDFC Asset Management are both listed businesses for example. On the liability side, funding source is healthy with term and current deposits (CASA) representing 48% of balance sheet. On the asset side, despite having a reputation of being a retail bank (53% of loan book) it has large product offering to corporate and SME clients also (47% of loan book). As illustrated in the chart below, corporate loan has nicely accelerated recently.

The management focuses on going deeper in the countryside and plans to accelerate network expansion by adding 600-800 branches per annum over the next few years. Deposit growth (15-17% pa) has been lagging loan growth (20-25% pa) hence it needs to accelerate customer acquisition. In order to increase customer engagement and empower physical presence, the company elaborated virtual relationship management (VRM) system. Each VRM will cater 1500-1600 customers remotely. It also partnered with government to access its 0.3M common services centers across the country in order to cross sell asset and liability products for a fee. HDFC Bank’s product portfolio is among the most comprehensive offerings on the market. Their ambition is to be a one-stop shop platform for all type of customers: save, pay, invest, borrow, insure, shop/ecommerce. Apart from internally developed or acquired products, the bank also enjoys from group effect. HDFC Life Insurance and HDFC Asset Management are both listed businesses for example. On the liability side, funding source is healthy with term and current deposits (CASA) representing 48% of balance sheet. On the asset side, despite having a reputation of being a retail bank (53% of loan book) it has large product offering to corporate and SME clients also (47% of loan book). As illustrated in the chart below, corporate loan has nicely accelerated recently.

Capital position is strong with Tier 1 at 15.8%. Non-performing loans are at healthy 1.4% with slight upside risk because of agriculture loans. ROA stands at 1.8% and cost-to-income ratio reached 40% in FY19 (vs. 50% in FY13). The latter has scope to fall further as the bank deploys its enhanced digital platform 2.0. A 35% level is feasible in 5 years. 75% of revenue is generated from net interest income and NIM margin has been stable at 4.4% over the last few years. The bank generates a ROE of 16.5% and trades at a FY03/20 PBV of 3.7x. Not a bargain but the bank has a proven track record of good execution and is a clear winner in today’s tough environment.

Stock focus: Asian Paints (revenue of $3bn; market capitalization of $19bn; 1% of GemEquity and GemAsia)

During our trip we visited Asian Paints showroom. It is the nb1 paint company in India, a highly underpenetrated market with only 3.75kg/ capita paint consumption (vs. 12-15kg globally). The company started its journey in 1942 when four friends decided to join forces and create a domestic paint leader. This position was achieved in 1967 and has been maintained ever since: 50% market share in organized retail. Promoters still hold 53% of capital. Products range comprises paints, water proofing, wall coverings and adhesives. Since 2013 the company has expanded into kitchen and bath segments through acquisitions. They have been leveraging their 60,000 dealer force across the country, adding 1,500-2,000 each year. They have also been emphasizing the service aspect: home deco consulting, collaboration with painters. Innovation being strong, they have been adding 20-30 new products every year. Most products sell at 5-10%premium to competition while gaining market. Benefitting from tax reform, paints GST dropped from 28% to 18%.

During our trip we visited Asian Paints showroom. It is the nb1 paint company in India, a highly underpenetrated market with only 3.75kg/ capita paint consumption (vs. 12-15kg globally). The company started its journey in 1942 when four friends decided to join forces and create a domestic paint leader. This position was achieved in 1967 and has been maintained ever since: 50% market share in organized retail. Promoters still hold 53% of capital. Products range comprises paints, water proofing, wall coverings and adhesives. Since 2013 the company has expanded into kitchen and bath segments through acquisitions. They have been leveraging their 60,000 dealer force across the country, adding 1,500-2,000 each year. They have also been emphasizing the service aspect: home deco consulting, collaboration with painters. Innovation being strong, they have been adding 20-30 new products every year. Most products sell at 5-10%premium to competition while gaining market. Benefitting from tax reform, paints GST dropped from 28% to 18%.

The company has just completed its capacity expansion (to 1,63MT/annum) improving its footprint in southern and eastern parts of the country. Management is guiding long term EBITDA margin to be around 17-18% (18.4% in FY03/2019) as they favor volume growth. Recent performance has been impacted by consumption slow down: over 80% of sales are coming from individuals. Also, crude price volatility impacted its margins over the last 18 months as it weighs 20% in raw material cost. Longer term however Asian Paints is a great franchise with strong execution team. The company earnings have been growing 18% CAGR since 2008. The stock trades at FY03/2020 PER of 51x.