We have spent a few days in Moscow to check on domestic consumer shape and preferences.

In general trade we met with management teams of X5 Retail, Magnit, Lenta, Detsky Mir among the listed players and Vkusvill and Fix Price for the ones expected to list by 2020. In internet we met Yandex, Mail, Qiwi (listed), Ozon and Rambler (private). Russian household spending has been subdued. Their purchasing power has not expanded since 2014. Nevertheless, the economy has been transformed and modernized, despite the implementation of sanctions. Since the World Football Cup Moscow has been offered a new face: historical buildings were restored and repainted. Tourists are walking in masses. Central streets are full of restaurants of all kind. Old manufacturing facilities and warehouses turned into western style food markets. Public transportation has been modernized. Sanctions are still there but the economy got accustomed somehow.

Macro focus: when redistribution will happen?

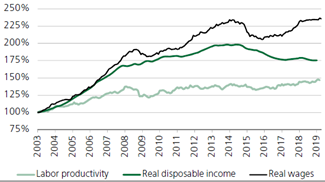

Russian economy has been driven by investment while consumer has seen its purchasing power in real terms falling (cf. the chart below).  And recent cost increases have been adding pressure: 200bps jump in VAT (to 20%) in January 2019, doubling of utility charges (property, waste treatment) and implementation of a painful pension reform last year. Meanwhile the export driven sector is performing well: trade balance surpassed before crisis levels, ie US$194bn in 2018 vs. US$90bn in 2016).

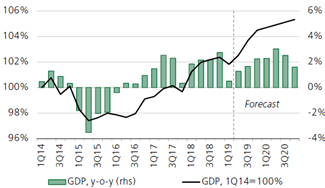

And recent cost increases have been adding pressure: 200bps jump in VAT (to 20%) in January 2019, doubling of utility charges (property, waste treatment) and implementation of a painful pension reform last year. Meanwhile the export driven sector is performing well: trade balance surpassed before crisis levels, ie US$194bn in 2018 vs. US$90bn in 2016).  Following the implementation of fiscal rule in 2016, Russian sovereign funds refilled their pockets: $177bn expected by year end and $220bn in 2020 (vs. $65bn in 2017). Ruble has stabilized and decorrelated somewhat from oil prices. Inflation remains low and has been revised down recently to 4.5% in 2019 (to compare with 5-5.5% target announced by Central Bank in January). Real rates are high and hence the 7.75% interest rate has scope to be lowered at least 50bps in 2019. In 1Q19 the economy only expanded by 0.5% yoy but as the infrastructure program unwidens, it is expected to accelerate going forward. Fiscal budget is set at $277bn, or 16.5% of GDP. Foreign investors’ appetite for Russia assets recovered: in April the government managed to raise $2.8bn in local currency denominated debt. However, the risk of additional sanctions remains an overhang for the sentiment and the currency.

Following the implementation of fiscal rule in 2016, Russian sovereign funds refilled their pockets: $177bn expected by year end and $220bn in 2020 (vs. $65bn in 2017). Ruble has stabilized and decorrelated somewhat from oil prices. Inflation remains low and has been revised down recently to 4.5% in 2019 (to compare with 5-5.5% target announced by Central Bank in January). Real rates are high and hence the 7.75% interest rate has scope to be lowered at least 50bps in 2019. In 1Q19 the economy only expanded by 0.5% yoy but as the infrastructure program unwidens, it is expected to accelerate going forward. Fiscal budget is set at $277bn, or 16.5% of GDP. Foreign investors’ appetite for Russia assets recovered: in April the government managed to raise $2.8bn in local currency denominated debt. However, the risk of additional sanctions remains an overhang for the sentiment and the currency.

Sector focus : retail. Companies: VkusVill : CA $1.3 bn, private ; X5 : sales $27 bn, market capitalization $8 bn.

« What does not kill you makes you stronger », used to say F. Nietzsche. This metaphor perfectly describes food retail sector in Russia now. When in 2014 sanctions hit the market, retail shelves turned empty and inflation skyrocketed. At first it was replaced with poor quality products but since then strong localization efforts were done. This time we were positively surprised by the abundance of fresh products on the shelves. Also new players have appeared in the space, like Vkusvill (The taste form the Farm). It is 820 stores food retail chain with the following value proposition: fresh products directly from the farmers to consumers. Stores are mostly located in Moscow (1.7% market share) and private label covers 95% of the

« What does not kill you makes you stronger », used to say F. Nietzsche. This metaphor perfectly describes food retail sector in Russia now. When in 2014 sanctions hit the market, retail shelves turned empty and inflation skyrocketed. At first it was replaced with poor quality products but since then strong localization efforts were done. This time we were positively surprised by the abundance of fresh products on the shelves. Also new players have appeared in the space, like Vkusvill (The taste form the Farm). It is 820 stores food retail chain with the following value proposition: fresh products directly from the farmers to consumers. Stores are mostly located in Moscow (1.7% market share) and private label covers 95% of the

assortment. The journey started as a small dairy products chain by a young entrepreneur Andrey Krivenko back in 2009. In 2012 he decided to expand into a multi-category store, but fresh is still predominant. Over 50% of delivered products are consumed the same day. Logistics are key. And the marketing concept is also outstanding: clients are invited to vote on a basket of purchased products and get a personalized promotion afterwards. It is all done through a mobile application. This process empowers clients to sort suppliers. The company adjusts its sourcing partners according to their ranking. Private equity fund Baring Vostok holds 12% of capital, the founder 68% and the rest of management 20% (average age is 35). Baring Vostok partners are planning an IPO in 2H20. The company generates $1.3 bn in sales, EBITDA margin of 8% and could be valued at $1 bn (if we apply X5 Reatil EV/EBITDA multiple of 9x). The management expects to reach 3,000 stores in 5 years going into St Petersburg and some other big cities. However, competitors remain sceptical.

Indeed, food retail sector ($250 bn in size) is already mature in Russia : 70% of the market is modern retail. The leader, X5 Retail is commanding 11% market share with 16,000 stores (15,000 proximity, 770 super and 91 hyper). It is followed by Magnit with 7.7%. Both continue to consolidate the market by adding 2,000 stores a year each. The rapid rise of VkusVill surprised them because it proved that they were wrong. F irst some consumers are ready to pay a premium for higher quality fresh products (20-30% higher price on average). Second promotional activity can be more efficient when targeted vs yellow tags on the shelves. Third, private label works in Russia.

irst some consumers are ready to pay a premium for higher quality fresh products (20-30% higher price on average). Second promotional activity can be more efficient when targeted vs yellow tags on the shelves. Third, private label works in Russia.

New management team at X5 recognized their past mistakes. They now target to increase the portion of private label to 20% in 3-5 years from 5% currently. Employee turnover rate and their satisfaction became part of top management KPIs. The quality of service is now a priority. Svetlana Demyashkevitch, CFO is also more enthusiastic about the omni-channel opportunity. The company has invested massively in technology and is today the best positioned to capture the trend. They are testing home delivery from their supermarkets. Proximity stores have turned into pick up points for e-commerce delivery. Internet is revolutionizing Russian consumers’ habits and is growing exponentially. Local leading multicategory e-commerce player OZON has been growing its value of new business 80% pa.

Sector focus: Internet revolution in Russia.

Revolution is also happening on roads. We already mentioned here Yandex (cf monthly report from March 2019). It is the leading search portal in Russia and favourite destination for local advertisers. But the new ambition of its founder Arkady Volozh is to become the leading transportation solution in Russia. Last May during a press conference, he reached the scene in a self-driven car powered by internally developed software system. Simultaneously the company promoted Yandex Taxi CEO Tigran Khudaverdyan to a newly created position of general vice director of Yandex group. It highlights where the focus is. The company plans to pilot hundred self-driven cars in Moscow in 2019.

Revolution is also happening on roads. We already mentioned here Yandex (cf monthly report from March 2019). It is the leading search portal in Russia and favourite destination for local advertisers. But the new ambition of its founder Arkady Volozh is to become the leading transportation solution in Russia. Last May during a press conference, he reached the scene in a self-driven car powered by internally developed software system. Simultaneously the company promoted Yandex Taxi CEO Tigran Khudaverdyan to a newly created position of general vice director of Yandex group. It highlights where the focus is. The company plans to pilot hundred self-driven cars in Moscow in 2019.

Yandex Taxi and Yandex Drive (car sharing) are changing customers habits: safety, cost, comfort. The traffic is dense, travelled distances are long and central  city parking is expensive. So why caring its own car? Yandex commands 80% market share in Moscow after merging with Uber. Competitors, such as Mail, are trying to grab some share but the brand and Yandex ecosystem are powerful. For example, while travelling in the beautiful muscovite underground, we noticed digital screens powered by Yandex browser in new trains. There, we also crossed a delivery man from Delivery Club (left side picture), Mail’s subsidiary. It is another domain where the two leading internet companies are disrupting consumers’ habits. The difference is that Mail paid $100M in 2016 for a company that operated in a quasi-monopolistic situation in Moscow. Yandex bought Foodfox in 2017 for $8.4M and since then changed the brand to Yandex Food. As per Yandex COO/CFO Greg Abovski, Yandex is now n°1 in Moscow. Both companies are losing money in food delivery. Mail has been focusing on its gaming portfolio. Yandex has been working on expanding and empowering its ecosystem: speakers, smart TV, music, video and all sort of other content. The idea is to increase the frequency of interaction with consumers

city parking is expensive. So why caring its own car? Yandex commands 80% market share in Moscow after merging with Uber. Competitors, such as Mail, are trying to grab some share but the brand and Yandex ecosystem are powerful. For example, while travelling in the beautiful muscovite underground, we noticed digital screens powered by Yandex browser in new trains. There, we also crossed a delivery man from Delivery Club (left side picture), Mail’s subsidiary. It is another domain where the two leading internet companies are disrupting consumers’ habits. The difference is that Mail paid $100M in 2016 for a company that operated in a quasi-monopolistic situation in Moscow. Yandex bought Foodfox in 2017 for $8.4M and since then changed the brand to Yandex Food. As per Yandex COO/CFO Greg Abovski, Yandex is now n°1 in Moscow. Both companies are losing money in food delivery. Mail has been focusing on its gaming portfolio. Yandex has been working on expanding and empowering its ecosystem: speakers, smart TV, music, video and all sort of other content. The idea is to increase the frequency of interaction with consumers