We have spent one week in Thailand. Our journey started in Khon Kaen, in the country northeast.

This city of 1.8 millions inhabitants is one of the first beneficiaries of rail investments made recently to upgrade the country infrastructure. It is considered a national role model for its smart city development. This visit has also enabled us to visit upcountry just before the general election. The street were surprisingly quiet, which was unexpected given we were one week away from general election, the first to be held for almost 8 years! We then travelled to Bangkok to participate in the CLSA ASEAN conference. This event gathered 89 companies and 300 investors.

We have met more than twenty companies from different sectors including the Masan group (conglomerate) from Vietnam, Hartalega (industry) from Malaysia, Universal Robina (FMCG) and Wilcon Depot (retailing) from Philippines, Mitra Adiperkasa (consumer) and Bank Negara Indonesia (financial services) from Indonesia, WHA Corp (industrial estate), Bangkok Dusit Medical Services and Mega Lifesciences (healthcare), CP All and Home Product Center (retailing), as well as Siam Cement (chemicals and cement) from Thailand. In the short term, upcoming elections in 3 countries of the region (Thailand, Indonesia, Philippines) have attracted much attention. Locals expect little surprise from Indonesia given President Jokowi’s popularity (59% in latest opinion poll). In Thailand, a new democratically elected government could restore investors’ confidence, even though the military are likely to remain in power. In the case of Philippines, companies feel relieved as inflation normalizes. Many hope the Duterte administration to accelerate fiscal reforms post mid-term election.

Macro Focus

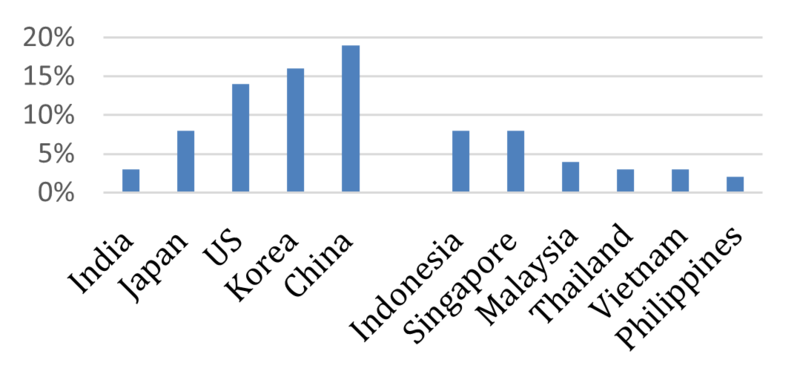

ASEAN remains one of the most dynamic regions in the world in terms of growth even if its forecasts have been slightly revised down. Top exporting countries with higher exposure to China (Malaysia) are among the most affected by external headwinds. Some of the countries are able to offset this decline by better domestic demand and investments. In mid/long term, this risk could decrease thanks to the supply chain reconfiguration to the ASEAN region. While the sharp increase of China’s labor cost has already pushed some companies to look elsewhere, the US China trade tension could further accelerate this movement. Already integrated into the regional supply chain, countries such as Vietnam, Thailand and Malaysia could be potential winners.

ASEAN remains one of the most dynamic regions in the world in terms of growth even if its forecasts have been slightly revised down. Top exporting countries with higher exposure to China (Malaysia) are among the most affected by external headwinds. Some of the countries are able to offset this decline by better domestic demand and investments. In mid/long term, this risk could decrease thanks to the supply chain reconfiguration to the ASEAN region. While the sharp increase of China’s labor cost has already pushed some companies to look elsewhere, the US China trade tension could further accelerate this movement. Already integrated into the regional supply chain, countries such as Vietnam, Thailand and Malaysia could be potential winners.

Overall, headwinds pare as dollar ease on less aggressive monetary tightening by the FED. Such environment benefits the whole region. However, countries with high current account deficit such as Indonesia and Philippines are among the most sensitive ones. The diminished inflation pressure should enable local central banks to be more flexible. Real interest rates remain high in Indonesia and Philippines and have room to shrink.

In Thailand, consumption is resilient and continues to support economic growth. Fiscal and social subsidies are deemed necessary in an environment where the rural economy stays weak because of subdued farm prices while household debt remains elevated (78% of GDP). CVS leader CP All noticed a slightly improvement in its sales, but Home Product Center (similar to Home Depot in US) continues to observe weakness in upcountry. The budget deficit could reach 3.5% this year but

the trade balance will stay in surplus (6% of GDP). After the elections, the execution of infrastructure projects could become a new driver of economic growth.

Indonesia’s double deficit (fiscal and current) remains a major economic concern for the country. The trade deficit could stay elevated as campaign spending-backed private consumption and infrastructure related demand could provide support for imports. Although the government uses pre-electoral social transfers to boost domestic demand, the fiscal deficit should not exceed 2.5% of GDP. Moreover, the country gets relief from lower oil price and Fed’s rate hike pause. We expect better demand post elections. According to Bank Negara Indonesia, credit growth could reach 12-14% this year, from 12% in 2018.

With growth projected at 6% this year, Philippines will underperform its official target (7-8%). The country is also experiencing double deficit. However we have noted strong domestic demand backed by public expenditure and accelerated remittance growth ($30bn in 2018, +3.9% yoy). Economic outlook also improves with falling inflation, from >6% at the peak of last year to 3.1% this year (thanks to normalization of food prices). We expect fiscal reforms to happen post mid-term elections. Should this structural improvement happens, it would have a positive impact on public accounts and renew investors’ confidence.

Stock focus: SEA Limited (sales of $2bn, market capitalization of $10bn)

We have met SEA Ltd, a dominant Internet company in the ASEAN region. Created in 2009 as an online game distribution platform, Sea Ltd has a close relationship with Tencent, its major shareholder (36%).

Its subsidiary Garena distributes some of the most popular games in ASEAN, including League of Legends (MAU at 80M+ in the world) and positions itself as the leading  eSports organizer in this region. The success of its internally developed Free Fire (contributes to almost half of the revenue of digital entertainment division) in international markets, also open up new perspectives.

eSports organizer in this region. The success of its internally developed Free Fire (contributes to almost half of the revenue of digital entertainment division) in international markets, also open up new perspectives.

Via its subsidiary Shopee, one of the largest e-commerce platforms in ASEAN region with cross boarder capabilities, SEA positions itself as the only true competitor to Lazada (controlled by Alibaba) in a market (6 ASEAN countries plus Taiwan) of 600 million people. In fact, Shopee leads in every of its markets by GMV ($10bn in 2018) which could double in 2019, so does the number of orders.

SEA also offers payment solutions via its subsidiary AirPay. This digital wallet is mostly used by Shopee and Garena customers for the moment. It is in a weaker competitive position compared to dominant players such as Alipay, Tenpay and ApplePay. However, the group feels confident about its future as Fintech is still in its nascent stages in many ASEAN countries. Future development in new areas such as remittance could further enhance the apps’ competitiveness.

In order to support its strong growth (Garena sales could grow 82-97% this year and Shopee could grow at 117-127%), SEA continues to make important investments. The company is not expected to be EBITDA positive before 2021. However its losses should decline as an absolute amount thanks to scale and better monetization.

Stock focus: Home Product Center (sales of $2bn, market capitalization of $6.2bn), Wilcon Depot (sales of $0.5 bn, market capitalization of $1.2bn)

We have met Wilcon Depot and Home Product Center, two companies specialized in the home improvement sector. Through a large network of established stores (52 for Wilcon and 108 for Home Pro), both companies lead in their respective domestic market (Philippines and Thailand) with 20 to 25% market share.

We have met Wilcon Depot and Home Product Center, two companies specialized in the home improvement sector. Through a large network of established stores (52 for Wilcon and 108 for Home Pro), both companies lead in their respective domestic market (Philippines and Thailand) with 20 to 25% market share.

Despite their “cultural” differences, one as a family business still run by the founding family (Wilcon Depot) and the other as a JV between Land & Houses and Quality Houses (HomePro), they have both adopted the same positioning of “one stop shop”. A very large range of SKUs could be found at their stores: 40,000 to 80,000 SKUs on average for HomePro and up to 150,000 at Wilcon Depot. And they both offer a large collection of well-known private label products and exclusive brands.

Having over 50% of sales exposure to product categories such as tiles/flooring and plumbing & sanitary, Wilcon Depot is more sensitive to the construction market. Home Pro, on the other hand, is more exposed to the renovation segment (80% of sales). They also differentiate from each other in terms of procurement: HomePro buys 90% of its products in Thailand while Wilcon imports the majority of its products.

Both companies target market expansion outside capital cities and each of them plans to open 8 stores this year. For HomePro, rural stores have lower productivity but the group margin would continue to expand thanks to increased private label penetration. In the case of Wilcon, it is able to offset higher logistic cost related to new stores outside Metro Manila by flexible merchandising and pricing. As to the operating environment, Wilcon is better off thanks to stronger domestic consumption: its organic growth could reach 6% this year vs 3% for Home Pro. Both companies have good financial health (35% gearing for Home Pro, net cash for Wilcon). Wilcon trades at premium to its Thai counterpart (2019PER of 33x vs 30x). Despite its higher valuation, we prefer Wilcon for its better growth potential. However at current level, both companies are too expensive.