We have spent 2 weeks in Mexico and Brazil, meeting local companies and investors: 3 days attending Santander conference in Mexico and 7 days on the road in Sao Paulo and Rio de Janeiro.

What a striking contrast between the two major Latam economies! Would that be the beginning of a new era? In Brazil we got used to socio-democrat politics since Lula election in 2002. The arrival of Jair Bolsonaro with his liberal team and pro-business reform agenda makes investors very positive. Meanwhile, in Mexico the election of Andrés Manuel Lopez Obrador (or AMLO) creates a lot of uncertainties. The GDP and earnings growth forecasts have been revised upward in Brazil, downward in Mexico. Equity index iBovespa is up +31% in US$ since the results of the presidential election first round on October 10, 2018. Mexbol index has been volatile since the election in July 2018 last year, down -5% in US$ terms. AMLO’s ambition is to reduce corruption which is well institutionalized.That is positive in the long term but it will take time and might create some pressure on the economy in the short term.

Local players (investors and companies) are aware of this environment as they are positive on Brazil and cautious on Mexico.

International investors however have somewhat different views as far as we can read the flows. They have been net sellers in Brazil post elections (skeptical on reform execution) but barely moved on Mexico (complacency). Among Brazilian companies, we met with Natura, Restoque, Arezzo, Carrefour Brasil, Pao de Açucar, Magazine Luiza, Burger King in consumer space; Ser and Estacio in education; Petrobras, Vale, Usiminas in energy and commodities; Banco do Brasil and BTG Pactual in financial services; Linx and Totvs in IT services and finally Intermedica, Odontoprev, Amil, Sulamerica in healthcare space. In addition, we met with Argentinean companies Pampa Energia and Banco Supervielle. In Mexico, we discussed with management teams of Liverpool, Coca Cola Femsa and Gruma in consumer space; Banco Banorte and Gentera for the financials and we met the emblematic CFO of highway concessionaire Pinfra.

(complacency). Among Brazilian companies, we met with Natura, Restoque, Arezzo, Carrefour Brasil, Pao de Açucar, Magazine Luiza, Burger King in consumer space; Ser and Estacio in education; Petrobras, Vale, Usiminas in energy and commodities; Banco do Brasil and BTG Pactual in financial services; Linx and Totvs in IT services and finally Intermedica, Odontoprev, Amil, Sulamerica in healthcare space. In addition, we met with Argentinean companies Pampa Energia and Banco Supervielle. In Mexico, we discussed with management teams of Liverpool, Coca Cola Femsa and Gruma in consumer space; Banco Banorte and Gentera for the financials and we met the emblematic CFO of highway concessionaire Pinfra.

Overall, we came back positive on Brazil. We believe the upcoming reform negotiations might create some volatility on the market. Congress is back from holidays on February 1st and the activity will really resume after the Carnaval. We also remain positive on Argentina; especially in the case of GDP growth acceleration in Brazil. However, we are cautious on Mexico. In fact, GemEquity has 14% of its AUM invested in Brazil and Argentina (vs. 8% for EM Index) and only 1% in Mexico (vs. 2.8% for the index).

Macro Focus: What a striking contrast!

2019 GDP growth expectations are as follows: 2.5% to 3% in Brazil, 1.7% in Mexico and -1% in Argentina. Inflation is expected to be similar in Brazil and Mexico at 4% and 26% in Argentina. As for the interest rates, the market anticipates convergence towards 7.5% by year end for both Brazil and Mexico. It is impressive how the 10-year interest rate differential has narrowed between the two countries over the last 4 years (see chart below).

Convergence of 10-year interest rates

On one hand it illustrates the drop in financial cost for Brazil. On the other hand, we might question the premium Mexican equity market is still trading with. Today Mexbol trades at a 2019 PER of 14.5x vs 13x for iBovespa (2x vs. 1.8x for 2019 PBV). In addition, latest estimates show +7% EPS growth in Mexico vs +17% in Brazil. Brazilian economy is expected to accelerate from a low base: the industrial capacity utilization level is at 75% and unemployment at 12.5%. In addition, the reform agenda, if executed, is very powerful. The new government team plans to pass pension reform, fiscal reform and privatizations. It is important to be quick in voting the reforms, running on the high popularity of Bolsonaro (60% approval rate).

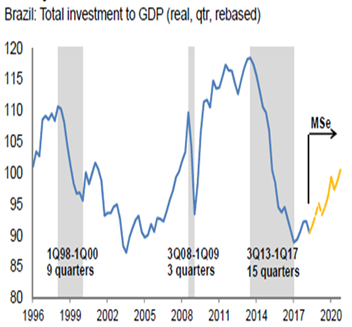

Total investment to GDP in Brazil (real, qtr, rebased)

We are impressed by the speed of consumer confidence rebound. As per Arezzo management (local female shoe designer), their luxury brand Alexandre Birman has been stellar and the best performer of the portfolio since last October.

Stock focus: CCR (market capitalization of $8.5bn, sales of $2.5bn, 2.6% of GemEquity)

CCR is one of the major concessionaires in Brazil. Its EBITDA breakdown is as follows: 87% highways; 8% urban mobility and 5% airports. 50% of national cargo is transported through CCR highways. In 2018, traffic growth turned negative for the major part of the year. It was affected by series of exceptional events. But its elasticity to GDP is 2x. So in case of GDP growth acceleration, recurrent revenue will rebound strongly in 2019.

CCR is one of the major concessionaires in Brazil. Its EBITDA breakdown is as follows: 87% highways; 8% urban mobility and 5% airports. 50% of national cargo is transported through CCR highways. In 2018, traffic growth turned negative for the major part of the year. It was affected by series of exceptional events. But its elasticity to GDP is 2x. So in case of GDP growth acceleration, recurrent revenue will rebound strongly in 2019.

Traffic has been overall weak since 2014

Until 2012, construction companies won numerous highway projects. They were aggressive in bidding as they were interested more in construction revenue than in recurrent operational revenue. Today many of these projects are no longer viable and during the recession several companies went bankrupt. As a consequence, fewer projects hit the auction process over the last 4 years. The situation will change radically over the next 3 years. CCR management is expecting 22 highways, 12 airports and at least 2 urban mobility projects to be auctioned by 2021. It translates into a minimum of BRL80bn (i.e. $22bn) of capex (excluding concession fees) over the next 3 years, of which BRL23bn in 2019 alone.

Most of the projects are brownfield so the execution risk is low. The government is also thinking about changing the pricing structure and asks for upfront concession fee payment. The idea is to favour cash rich companies that are more focused on the operational side of the projects. CCR should be the main beneficiary. The company did a follow-on back in February 2017 of BRL3.5bn. The proceeds were supposed to be deployed for inorganic growth but the deal did not go through. Today the company has a low leverage of 2.2x ND/EBITDA (BRL13bn of net debt on the balance sheet). If needed, the company can increase this leverage up to 3x, hence having at its disposal an additional BRL5bn for the prepayment. The management also said that the company would be ready to sell its airports portfolio and increase its firepower for more lucrative projects. (competition is expected to be more intense for airports). IRRs are expected to be between 8.5% and 10.5%, real unlevered. We came back even more positive on the name and increased its weighting within GemEquity to 2.6%.

Stock focus: Magazine Luiza (sales of $4.1bn, market capitalization of $8.4bn, 1% of GemEquity)

The company was created in 1957 in Franca, Sao Paulo state, by two salespeople: Luiza Trajano and her husband. The family is still involved in the business and holds 64% of the capital. Luiza Trajano (the daughter) is the chairwoman and her son Federico the CEO since 2015. The company is listed on Novo Mercado (higher governance level of iBovespa) since 2011.

The company was created in 1957 in Franca, Sao Paulo state, by two salespeople: Luiza Trajano and her husband. The family is still involved in the business and holds 64% of the capital. Luiza Trajano (the daughter) is the chairwoman and her son Federico the CEO since 2015. The company is listed on Novo Mercado (higher governance level of iBovespa) since 2011.

Historically a reseller of electronic goods and home appliances, Magalu now holds a nb2 position with 11.5% market share in the category. However since 2015, the company has changed its strategy and put the emphasis on both physical retail and ecommerce: omnichannel (integrating physical stores and ecommerce), marketplace (expanding SKUs) and other digital initiatives that might be launched soon. Today the company has 953 stores, 12 distribution centers and the famous Magazineluiza.com website. The number of SKUs available on the website is already 4M (vs. 40K in the stores) and this is just the beginning given that Magalu ambitions to become a full ecommerce player. In 2018 ecommerce already contributed 33% of sales!

A strong accent has been made on technology development back in 2014 when the company set up a dedicated department, LuizaLab. Today 200 developers are working on various projects. And some of them might change the face of the company again. During our meeting the management shared their excitement regarding a digital wallet that they plan to introduce later this year in their mobile app. Taking example on Chinese peers they would like to transform their MAGALU app into a multiservice destination: shopping, digital account, delivery. As of now there has been 23M downloads of the app (to compare with 12M active annual customers Magalu has in their stores) but less than 10% of total sales are coming from mobile. Moreover, the purchasing frequency is very low: 1.5x a year vs 40x for Amazon US and 80x for Alibaba! Also, likewise Alipay they plan to use the digital wallet to collect data on customers purchasing habits, sources of income and expenditures.

Despite a high valuation (2019 PER of 43x for a 28% earnings CAGR over the next 3 years) we believe the stock is attractive. Given the potential of new projects, growth might surprise on the upside. We invested 1% of GemEquity in the name.